- e-Procurement Preparation

- e-Procurement Basics

- Advanced e-Procurement

- e-Procurement Indicators

- Incorporating e-Procurement into Public Financial Management (PFM) reforms

Target audience

Avalanche Academy

Course “Interchain Messaging”

In this course, you will learn how to build cross-L1 Solidity dApps with Interchain Messaging and Avalanche Warp Messaging.

Course Content

Interoperability

In the first section, we cover some basic concepts of interoperability in multi-chain systems. You will learn about examples of interoperability between blockchains and the terms “source,” “destination,” and “message.”

Avalanche Interchain Messaging

In this section, we learn what Avalanche Interchain Messaging is and what is abstracted away from the general dApp developer. You will also build your first cross-L1 dApps.

Securing Cross-Chain Communication

In this section, we look at techniques to secure cross-chain communication. We dive into signature schemes, multi-signature schemes, and the BLS multi-signature scheme.

Avalanche Interchain Messaging Protocol

Avalanche blockchains can natively interoperate between one another using AWM. You will learn about the AWM message format and how the message flow works.

Learning Outcomes

By the end of this course, students will:

Topics

Completion Certificate

Avalanche Academy

Course “Interchain Token Transfer”

In this course, you will learn how to transfer assets across multiple Avalanche blockchains with Avalanche Interchain Token Transfer ICTT.

Course Content

Getting Started with Interchain Token Transfer

In this section, you will learn how to use our Interchain Token Transfer toolbox to perform cross-chain operations. We’ll guide you through the process of using our user-friendly interface to deploy contracts, create bridges, and transfer assets across the testnet chains (Fuji C-Chain, Echo, and Dispatch).

Tokens and Token Types

In this section, you will learn about the different types of tokens that can be transferred between Avalanche blockchains. We will cover ERC-20 and native tokens and how to deploy and transfer them using our toolbox. Furthermore, you will learn what wrapped native tokens are and how they can be used to transfer assets between chains.

Token Bridging

Next we will talk about the high level concepts of token bridging and demonstrate how to use our toolbox to create and manage bridge contracts for cross-chain transfers between the testnet chains.

Interchain Token Transfer Architecture

In this chapter we will look at the design of Avalanche Interchain Token Transfer. You will learn about the file structure of the contracts and the concepts of the token home and token remote.

ERC-20 to ERC-20 Bridge Implementation

You will learn how to use our toolbox to deploy ERC-20 tokens and create bridges to transfer them between the testnet chains.

Multi-Chain Token Operations

Here you will learn about the concept of multi-hops and how to use our toolbox to bridge tokens between multiple testnet chains.

Native to ERC-20 Bridge Implementation

In this chapter you will learn how to use our toolbox to bridge a native token as an ERC-20 token to another testnet chain.

Send and Call Operations

In this chapter you will learn how to use our toolbox to call smart contracts with the tokens after sending them to another testnet chain.

Cross-Chain Token Swaps

In this chapter you will learn how to perform cross-chain token swaps between the testnet chains using our toolbox.

Learning Outcomes

By the end of this course, you will:

Topics

Completion Certificate

Avalanche Academy

Course “L1 Tokenomics”

This course is designed to give you a deep understanding of tokenomics, including the creation, distribution, utility, and governance of tokens within blockchain ecosystems. By the end of this course, you will have practical skills in managing tokens across multi-chain ecosystems, configuring transaction fees, and designing staking and governance models.

Course Content

Basics

Learn the fundamentals of tokenomics, including native tokens, ERC-20 tokens, wrapped tokens, and how token decimals affect transactions and supply.

Native Tokens

Explore how to create custom native tokens, use Avalanche’s native token minter, and integrate ERC-20 tokens as native tokens in cross-chain environments.

Multi-Chain Ecosystems

Delve into interchain token transfers and cross-chain functionality, using both ERC-20 and native tokens across multiple blockchains.

Staking

Understand staking tokens, liquid staking, and how to deploy staking contracts, with a focus on post-Etna upgrade features.

Transaction Fees

Master transaction fee configuration, dynamic fee models, and learn how to distribute fees effectively within decentralized ecosystems.

Token Distribution

Learn about initial token allocation, advanced vesting schedules, bonding curves for token pricing, and how to implement airdrops.

Governance

Study governance models, DAOs, quadratic voting, and the latest innovations in governance (Governance 2.0) for decentralized decision-making.

Learning Outcomes

By the end of this course, you will:

Topics

Completion Certificate

Avalanche Academy

Course “Avalanche Fundamentals”

This online course introducing you to the exciting world of the Avalanche technology! This course will provide you with a comprehensive understanding of the basic concepts making Avalanche unique.

Throughout, you’ll learn the key features and benefits of the platform, plus how to build on it. You can also ask our expert instructors questions.

By the end of these courses, you’ll have the knowledge and skills to leverage the power of blockchain technology for your own projects and applications. We’re excited to have you join us on this journey and can’t wait to see what you’ll create with Avalanche!

By the end of this course, you will:

You can evaluate your own understanding of the material through quizzes and claim a certificate for successful completion at the end.

Overall, this course aims to provide a foundational understanding of Avalanche. By completing it, you will be better prepared to take on more advanced courses focused on building on Avalanche.

Topics

CERTIFICATE OF COMPLETION

Udemy.com

via Udemy.com Platform

04.06.2022

Online Educational Course “ECBA prep Training”

Online Educational Course “CBAP Prep Training”

Online Educational Course “CBDA prep Training”

Online Educational Course “CCBA Prep training”

Course content:

Udemy.com

via Udemy.com Platform

03.06.2022

Online Educational Course “What Is Business Analysis for Information Technology”

The content of the modules:

University of Pennsylvania

University of Pennsylvania

via coursera.org Platform

31.01.2022

Online Educational Course “English for Career Development“

Syllabus:

Cryptozombies

via Cryptozombies.io Platform

16.03.2020

Online Educational Course “Solidity Path: Beginner to Intermediate Smart Contracts”

The content of the modules:

Project

Coursetro

via Coursetro.com Platform

04.03.2020

Online Educational Course “Developing Ethereum Smart Contracts for Beginners“

The content of the modules:

1. What are Smart Contracts and Decentralized Apps?

2. Variables and Types

3. Creating a Web UI for our Smart Contract

4. Solidity Events

5. Function Modifiers

6. Mappings and Structs

7. Inheritance & Deployment

8. Finishing the Web3 UI

Project

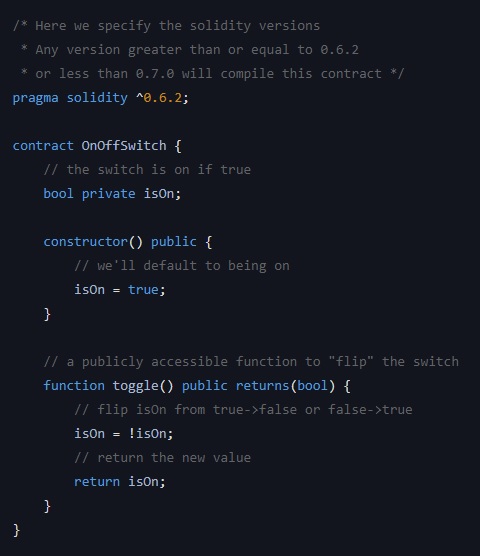

University at Buffalo

via coursera.org Platform

04.03.2020

Online Educational Course “Smart Contracts“

This second course of the Blockchain specialization will help you design, code, deploy and execute a smart contract – the computational element of the blockchain technology.

Smart contracts allow for implementing user-defined operations of arbitrary complexity that are not possible through plain cryptocurrency protocols. They allow users to implement conditions, rules and policies of the domain applications. Smart contracts are a powerful feature that, when properly designed and coded, can result in autonomous, efficient and transparent systems.

You will design and program smart contracts in Solidity language, test and deploy them in the Remix development environment, and invoke them from a simple web interface that Remix provides.

This course features best practices for designing solutions with smart contracts using Solidity and Remix IDE. Main concepts are delivered through videos, demos and hands-on exercises.

Syllabus:

WEEK 1. Smart Contract Basics

The purpose of this module is to introduce the reasons for a smart contract and its critical role in transforming blockchain technology from enabling decentralized systems. We will explore the structure and basic concepts of a smart contract through examples, and illustrate Remix (remix.ethereum.org) web IDE for deploying and interacting with a smart contract.

WEEK 2. Solidity

Our goal is to master the basics of Solidity, a high-level language that is a combination of Javascript, Java and C++. It is specially designed to write smart contracts and to target the Ethereum Virtual Machine. Learners will be able to follow demonstrations and practice using Solidity.

WEEK 3. Putting it all Together

This module focuses on the development of the Ballot smart contract incrementally to illustrate various features including time dependencies, validation outside the function code using access modifiers, asserts and require declarations, and event logging.

WEEK 4. Best Practices

This module will focus on best practices including evaluating whether a blockchain-based solution is suitable for your problem, designing Solidity smart contracts, and those relating to Remix IDE.

Bitdegree

via Bitdegree.org Platform

03.03.2020

Online Educational Course “Learn Solidity with Space Doggo: an Interactive Solidity Tutorial”

The content of the modules:

Project

Altcademy

via Altcademy.com Platform

01.03.2020

Online Educational Course “Ethereum Smart Contract 101”

The content of the modules:

Project

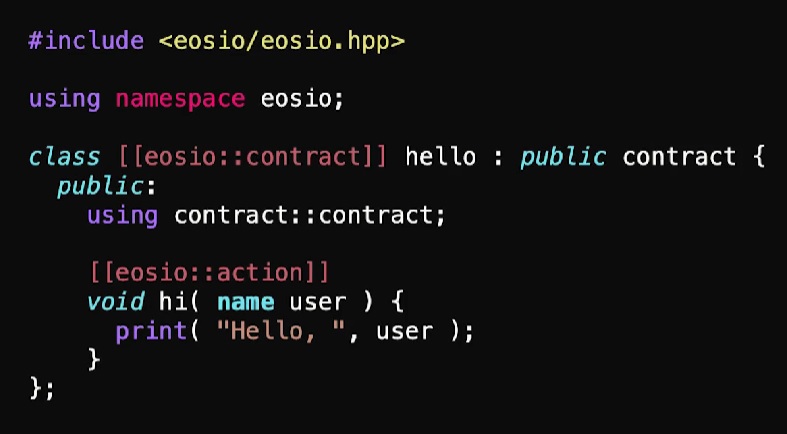

Eos.io

via Training.eos.io Platform

06.02.2020

Online Educational Course “Smart Contracts 201”

The content of the modules:

Module 1: Assets

Module 2: Receiving Transfers

Module 3: In-line Actions

Module 4: Singletons

Module 5: Bonus Lab: Add a “Pot” to Tic Tac Toe Games

Module 6: Updating Table Schemas and Migrating Data

Module 7: Getting Data from the Outside World

Module 8: Organizing Action Parameters

Module 9: Randomness

Module 10: Scheduled and Recurring Actions

Module 11: User-Friendly Resource Management

Module 12: More to Explore: Interoperability and Testing Frameworks

Eos.io

via Training.eos.io Platform

05.02.2020

Online Educational Course “Smart Contracts 101”

The content of the modules:

Project

Chainshot by Alchemy

via Chainshot.com Platform

04.02.2020

Online Educational Course “Introduction to Solidity”

The content of the modules:

Project

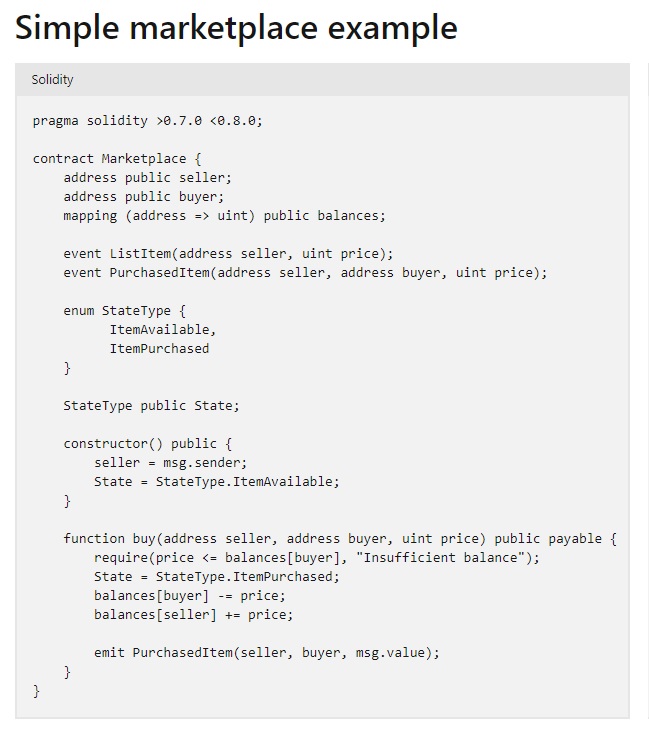

Web3.university

via Web3.university Platform

03.02.2020

Online Educational Course “How To Create Your First Smart Contract”

The content of the modules:

Project

Hello World smart contract from the Ethereum Foundation

// Specifies the version of Solidity, using semantic versioning.

// Learn more: https://solidity.readthedocs.io/en/v0.5.10/layout-of-source-files.html#pragma

pragma solidity >=0.7.3;

// Defines a contract named `HelloWorld`.

// A contract is a collection of functions and data (its state). Once deployed, a contract resides at a specific address on the Ethereum blockchain. Learn more: https://solidity.readthedocs.io/en/v0.5.10/structure-of-a-contract.html

contract HelloWorld {

//Emitted when update function is called

//Smart contract events are a way for your contract to communicate that something happened on the blockchain to your app front-end, which can be 'listening' for certain events and take action when they happen.

event UpdatedMessages(string oldStr, string newStr);

// Declares a state variable `message` of type `string`.

// State variables are variables whose values are permanently stored in contract storage. The keyword `public` makes variables accessible from outside a contract and creates a function that other contracts or clients can call to access the value.

string public message;

// Similar to many class-based object-oriented languages, a constructor is a special function that is only executed upon contract creation.

// Constructors are used to initialize the contract's data. Learn more:https://solidity.readthedocs.io/en/v0.5.10/contracts.html#constructors

constructor(string memory initMessage) {

// Accepts a string argument `initMessage` and sets the value into the contract's `message` storage variable).

message = initMessage;

}

// A public function that accepts a string argument and updates the `message` storage variable.

function update(string memory newMessage) public {

string memory oldMsg = message;

message = newMessage;

emit UpdatedMessages(oldMsg, newMessage);

}

}

Microsoft

via Learn.microsoft.com Platform

01.02.2020

Online Educational Course “Write Ethereum smart contracts by using Solidity”

The content of the modules:

Project

Microsoft

via Learn.microsoft.com Platform

01.02.2020

Online Educational Course “Learn how to use Solidity”

The content of the modules:

Project

Smartly Institute

via Smart.ly Platform

05.08.2018

Online Educational Course “Marketing Fundamentals”

Averages, Quartiles, and the Five Number Summary

Descriptive statistics: A way to quickly summarize data within a set using just a few numbers.

Mean: The average of a set calculated by adding all the values in the set and dividing by the number of values in the set.

Outlier: A value or values significantly higher or lower than the rest of the set that can skew the mean of a set.

Median: The middle value in a data set.

Mode: The value that appears most often in the set.

When a set has two modes it is called bimodal. When it has more than two modes, it is multimodal.

Standard deviation: A measurement of the amount of variation from the mean in a data set.

For example, if a data set has a mean of 50 units and a standard deviation of 20 units, we can conclude that most of the data will fall between 30 and 70 units.

Five number summary: The minimum, first quartile, median, third quartile, and maximum of a data set.

Each quartile represents 25% of the data within a set.

The first and third quartiles can be found by identifying the medians of the lower and upper halves of the data.

Range: The distance between the maximum and minimum.

Interquartile range (IQR): The distance between the third and first quartiles.

Graphical Organization

Boxplot: A graph representing the five number summary.

The boxed area represents the IQR with the median at the center.

Frequency distribution: A table that sorts data into equally-sized classes.

Frequency: The amount of data points that fall into each class.

Cumulative frequency: The running total of the frequencies.

Relative frequency: The frequency divided by the total number of data points.

Cumulative relative frequency: The running total of the relative frequencies.

Histogram: A frequency distribution shown in graph form.

Certificate

Smartly Institute

via Smart.ly Platform

04.08.2018

Online Educational Course “Marketing Fundamentals”

Marketing Basics

Marketing: The process of creating, communicating, and delivering perceived value to customers.

Value: The practical and emotional benefits that the buyer of a product gets from it. Each benefit stems from a specific feature of the product.

Perceived value is the value that people believe they will receive from a product.

A product can be a tangible good, such as a pair of shoes, a service (e.g., a doctor’s check-up), or intellectual property (e.g., song lyrics).

Marketing strategy: A plan of what to sell, whom to sell it to, and how to sell it that is focused on long-term profit, rather than shortterm gains.

Conducting a Situation Analysis

Situation analysis: An evaluation of a company’s resources and capabilities, its competitors, and general market demand. A situation analysis consists of two tasks:

1. Examining the four C’s: company, competitors, customers, and collaborators.

2. Interpreting the information gathered in the four C’s within the framework of a SWOT analysis, which describes the company’s strengths, weaknesses, opportunities, and threats.

Segmentation, Targeting, and Positioning

Segmentation, targeting, and positioning (STP): A process used to tailor marketing efforts to relevant audiences and thus ultimately maximize revenue.

Segmentation divides consumers into distinct groups, or segments, based on homogeneity in certain attributes, distinction in these attributes from customers in other segments, and a similar reaction to marketing messages.

Targeting is the process of selecting which segment(s) of consumers to focus marketing efforts on—i.e., the target audience.

Positioning defines how a company wants its product to be perceived by consumers it markets to, relative to competing products.

Value Propositions

The value proposition (VP) is:

1. The benefits that a product provides to the target audience.

2. A statement describing these benefits.

Unique selling proposition (USP): A type of value proposition statement that communicates the essence of what makes a product unique to the target audience.

The Four P’s

The four P’s—product, price, place, and promotion—constitute the marketing mix that a company must consider in order to create a marketing strategy. These four factors are under the company’s control: the company decides what product to offer, what price to charge for it, where to place it for sale, and how to promote it. The marketing mix needs to be adjusted over the course of the product life cycle as the types of customers who buy the product and the quantity of demand change.

Positioning statement: A statement describing the core benefits that a product offers, used internally to guide product messaging.

Certificate

Smartly Institute

via Smart.ly Platform

03.08.2018

Online Educational Course “Microeconomics 1: Supply and Demand”

Introducing Microeconomics

Microeconomics: The study of how individuals, households, and firms make decisions about using limited resources.

Economic resources include:

Human resources: Workers and managers.

Nonhuman resources: Land, technology, minerals, oil, etc.

Microeconomists assume that people and firms are rational and seek to maximize benefits.

Trade-offs: Choosing one thing requires giving up another.

Scarcity: The existence of limited resources.

When an individual or group makes a decision, their opportunity cost is equal to the value of the foregone option(s).

Economic units: People, households, and firms.

Marginal benefits: Small, incremental benefits.

Supply and Demand

The law of demand: When the price of a good increases, demand for it decreases, and vice versa.

Demand schedule: Lists the quantity demanded of a product or service at various prices.

Market demand schedule: A demand schedule that encompasses the entire market’s demand for a good or service at various price points.

Demand curve (DC): Plots the quantity of a good or service demanded at different prices.

Market demand curve: Shows the market demand schedule.

When demand curves shift:

to the left—market demand has decreased.

to the right—market demand has increased.

Market price: The price at which a good or service is offered in the marketplace.

Law of supply: When the market price for a good increases, the quantity that suppliers produce and sell increases, and vice versa.

Supply schedule: Lists the quantity of a product supplied at various price points.

Supply curve (SC): Plots the supply schedule.

Market supply: The summation of all of the individual supplies of a good or service.

Market supply curve: Shows how the total quantity supplied of a good changes as its price changes.

When supply curves shift:

to the left—market supply has decreased.

to the right—market supply has increased.

Factors Contributing to Equilibrium

Equilibrium: When the amount of goods supplied is equal to the quantity demanded.

Equilibrium price: The price where equilibrium occurs ($9 on the chart).

Equilibrium quantity: The quantity where equilibrium occurs (400 on the chart).

Equilibrium point (EP): The point at which the equilibrium price is equal to the equilibrium quantity.

Price acts as a motivator:

When there is a low price for goods or services, consumers buy more and sellers supply less.

When there is a high price for goods or services, consumers buy less and sellers supply more.

Law of supply and demand: The price of any good will naturally adjust until market equilibrium is reached.

Supply > demand: There is a surplus. Prices will drop until equilibrium is met.

Demand > supply: There is a shortage. Prices will rise until equilibrium is met.

Supply = demand: The market has reached equilibrium.

To recognize events that alter equilibrium:

1. Identify a shift in the DC and/or the SC.

2. Determine if the curve(s) shift left or right.

3. Use a graph to see how the shifts change the EP.

Certificate

Smartly Institute

via Smart.ly Platform

02.08.2018

Online Educational Course “Accounting 1: Fundamentals”

Introducing the Balance Sheet

All companies must follow a set of rules that standardizes the reporting and recording of their financial data.

While US companies follow Generally Accepted Accounting Principles (GAAP), companies in most other countries follow the International Financial Reporting Standards (IFRS). The balance sheet gives a glimpse into the health and composition of a business.

Double-entry bookkeeping: A transaction requires at least two entries to keep the balance sheet balanced.

Dual-aspect concept: If there is a change in the total amount of assets, there needs to be a resulting change in liabilities, equity, or both.

Money-measurement concept: Only items expressed as monetary amounts can go on a balance sheet.

Entity: A business, company, or organization.

Entity concept: A business’ finances are separate from its owner’s finances.

Going-concern concept: Accounting assumes that an entity will operate indefinitely.

Assets, Liabilities, and Equity

Assets: Items owned and controlled by an entity, valuable to the entity, and acquired at a measurable cost.

Current assets are assets expected to be converted into cash or used up by the business within one year.

Accounts Receivable: Where a company records credit purchases by its customers. The company expects these customers to pay them in cash in the near future.

Inventory: Goods an entity intends to sell.

Prepaid Expenses: Monies paid in advance for pending expenses—for example, paying rent in advance. Noncurrent assets will not be used up or converted into cash for at least one year.

Property, Plant and Equipment (PP&E): Tangible assets that depreciate, or lose value, over time due to wear and tear.

Creditor: Anyone who lends money or extends credit.

Liabilities: Debts owed to outside entities (creditors) in return for borrowed goods, services, or monies.

Current Liabilities: Obligations that will be paid within one year.

Long-Term Liabilities: Obligations that won’t be paid until at least a year has passed.

Bank Loans (Bank Loan Payable) can be recorded under both current and long-term liabilities.

Accounts Payable: Obligatory monies owed by an entity for goods and services. The opposite of Accounts Receivable.

Estimated Tax Liability: The estimated amount of what will be due in taxes per year.

Equity: Money (capital) either supplied by equity investors or collected in the form of an entity’s retained earnings.

Paid-In Capital: Money supplied by investors.

Retained Earnings: Income generated by an entity’s successful operations that is reinvested in the entity.

Proprietorship: An entity with one sole owner and investor.

Account Types

T-accounts: Charts used to record increases and decreases of individual accounts found on the balance sheet.

Debits: Represent an increase in an asset but a decrease in a liability or equity.

Credits: Represent a decrease in an asset but an increase in a liabilty or equity.

Asset accounts will normally have debit balances. Liability & Equity accounts will normally have credit balances.

Two special equity accounts are Revenues and Expenses. Revenues are increases in equity and usually have a credit balance. Expenses are decreases in equity and usually have a debit balance. Revenues are debited and credited like other equity accounts, but Expenses are debited and credited like asset accounts.

Accounting Transactions

Income Statements are used to calculate net income.

Net Income: The difference between total revenues and total expenses.

Net Income = Total Revenues — Total Expenses

Balance Sheets record one point in history and show a company’s financial position. Income Statements measure a company’s financial performance over a period of time.

General Journal: The chronological record of every transaction. A journal uses the same rules as a T-account.

General Ledger: The collection of all T-accounts.

Revenues and Expenses are temporary accounts. At the end of a period they are closed out and their balances are transferred to the income statement. Other asset, liability, and equity accounts are permanent accounts. They are not closed out, and their balances are transferred to the balance sheet.

Certificate

Smartly Institute

via Smart.ly Platform

01.08.2018

Online Educational Course “Finance: Time Value of Money”

Present Value and Future Value

Time value of money: Money in the present is worth more than the same amount of money in the future.

Present value: The value of a sum of money today. Present value calculations move money backwards in time.

Future value: The value of a sum of money at a specific time in the future. Future value calculations move money forwards in time.

The Timeline

Timeline: A tool used for visualizing a time value of money scenario. The periods of a timeline must always be equal.

Inflows of cash are positive numbers and outflows of cash are negative numbers.

Compounding and Discounting

Compounding is the process used to move money forward in time:

Increases the value of a sum of money

Involves multiplication

Calculates future value

Discounting is the process used to move money backward in time:

Decreases the value of a sum of money

Involves division

Calculates present value

Net Present Value

Net present value (NPV): The difference between the present value of all benefits and present value of all costs of a particular investment.

Benefits are represented by cash inflows (positive).

Costs are represented by cash outflows (negative).

Net present value is represented by this equation:

NPV = PV(benefits) – PV(costs)

A positive NPV (inflows > outflows) is an indication that a firm should invest in a project.

Moving Money Over Time

To compare or combine cash flows, they must be moved forward or backward to the same point in time.

Certificate

Georgia Institute of Technology

via coursera.org Platform

10.06.2018

Online Educational Course “Supply Chain Principles“

This course will provide a solid understanding of what a supply chain is all about. The course:

– Provides an introduction to Supply Chain

– Leverages graphics to promote the Integrated Supply Chain model

– Emphasizes understanding the Extended Supply Chain

– Presents a holistic approach – Incorporating People, Process, and Technology

– Calls-out industry-specific supply chain

– Leverages discussions, videos, quizzes, and questions for consideration

– Provides awareness of career path opportunities

– Presents emerging and futuristic trends in supply chain and given that at GT we are focused on developing what’s next in the world, we include Discussion of emerging and futuristic trends in supply chain.

There is very little math involved in this course – so don’t worry at all about your math skills.

The course incorporates reading materials that were developed as part of a $24.5M TAACCCT grant awarded by the U.S. Department of Labor’s Employment and Training Administration to the LINCS in Supply Chain Management consortium.

This course is designed for a wide range of learners including:

– Individuals working in a supply chain domain interested in improving their knowledge of supply chain

– Individuals curious about pursuing a career in supply chain

– Students working or studying in an adjacent business field

– Seasoned professionals who may be moving to a new area of supply chain

– Hobbyists – seeking to learn more about the world around them

World Bank Academy

10.06.2018

Online Educational Course “e-Procurement Learning”

This e-Learning course is designed to provide participants with an in-depth understanding of the concept of public procurement and e-Government Procurement (e-GP) and how e-Procurement solutions can be designed and implemented in a more effective and economical way. This course outlines how to prepare a strategy for establishing an e-GP framework and presents in detail basic and advanced tools of e-Procurement systems. Moreover, it describes the need for the establishment and use of public procurement indicators, as well as how public financial management can be strengthened through the incorporation of procurement and e-Procurement into PFM reform projects.

Course overview

E-Government procurement (e-GP) projects are often part of the wider e-government efforts of countries to efficiently and effectively serve their citizens and businesses. E-GP promotes better governance in public procurement by increasing transparency and eliminating opportunities for fraud and corruption. The application of ICT to procurement processes has resulted in e-Procurement platforms that are ideally suited to address the e-GP objectives.

Pursuing an e-Procurement system implementation is an effective way to improve public procurement management, through the automation of all underlying processes. Many governments worldwide have adopted end-to-end e-Procurement systems which cover the full procurement cycle.

The current e-Learning course is composed of five modules, aiming to assist its audience to better understand electronic procurement and provide them with guidance on decisions they may need to take for establishing or improving the e-GP framework of their countries.

The course initially focuses on how organizations can establish a plan for an e-GP implementation, and what benefits can be expected by such an implementation project. Furthermore it provides an overview of the basic and advanced features and modules of e-Procurement systems, along with concise information on how to implement each of the described e-Procurement modules.

Additionally, the course briefly describes e-Procurement indicators and presents how these can be used by governments in order to measure adoption, performance and overall governance. Lastly, it focuses on how to incorporate procurement and e-procurement into FMIS implementations in the context of PFM reform projects.

At the end of this course, a certification can be obtained by those participants who complete the course and successfully pass the respective examination.

Course features

The course is composed of the following modules:

Target audience

The learners should at least have an understanding of the national public procurement setting and the EU public procurement procedures as well as a high-level view of web-based applications and software implementation projects.

Score

Certificate

Ministry of Business, Innovation and Employment, NZ

05.06.2018

Online Educational Course “Demystifying Procurement”

Demystifying Procurement is an introductory online course that gives you tools and techniques to help you with your procurement.

This introductory course is especially useful for:

Course outline

This free introductory training course covers the eight stages of the procurement life-cycle in four short modules.

By the end of the course you should have an understanding of:

There are four self-paced modules with interactive graphics and tables, links to procurement tools and guidance on this website and practice questions at the end of each section.

Module 1 covers the project initiation, needs and market analysis sections of the planning phase. The module will take you through identifying and understanding key stakeholders and their needs, putting together a project team, probity considerations and understanding the supply market.

Module 1 should take about 30 minutes to complete.

Module 2 covers the specification of requirements and planning approach to market sections of the planning phase. The module will take you through key considerations when specifying your requirements, determining which approach to market strategy is right for the procurement, evaluation methodology, what should go into the procurement plan and starting to think about the contract construct.

Module 2 should take about 30 minutes to complete.

Module 3 covers the sourcing phase of the procurement life-cycle, including approach to market; supplier selection and contract negotiation and award. The module will take you through what needs to go into your RFx documentation, publishing a notice of procurement, convening the evaluation panel and evaluating responses, negotiation theory, contract arrangements and debriefing unsuccessful respondents.

Module 3 should take about 50 minutes to complete.

Module 4 covers the manage phase of the procurement life-cycle, including managing the contract and relationships and reviewing procurement outcomes. The module will take you through the three key elements of contract and relationship management, the relationship spectrum, dispute resolution considerations and the review cycle.

Module 4 should take about 25 minutes to complete.

Alison

via Alison.com Platform

03.06.2018

Online Educational Course “Forecasting – Winter’s Models, Goodness of forecast, Aggregate Planning, Tabular Method”

by G. Srinivasan

Learn how aggregate planning is used in many businesses to match supply and demand of output over the medium time range of up to approximately 12 months in the future by studying the course Applied Operations Management – Aggregate Planning.

Aggregate planning allows management to quantify materials and other resources that are to be procured so that the total cost of operations are kept to the minimum over a set period of time. The course begins by introducing the concept of aggregate planning and its use in medium term planning in businesses. You will be introduced to aggregate planning methodologies such as the tabular method and linear programming.

You will learn how a tabular approach uses spreadsheets and the values of different variables, such as production by regular workforce and inventory levels can be calculated by using the costs associated with production, overtime, subcontracting, hiring, inventory and back-orders. The tabular method is widely used because it is easy to understand and utilize. However, the generated solution may not be optimal and many trials and errors may be needed to find the optimal solution. The course also introduces the linear programming technique and a special type of linear programming known as the Transportation Model, which can be used to obtain aggregate plans that would allow balanced capacity and demand and the minimization of costs.

This course will be of great interest to all professionals working in the areas operations management or general management who would like to learn more about aggregate planning and the methods used in this important area of operations management. The course will also be of interest to all learners who are interested in operations management as a future career.

The key points from this module are:

Forecasting can be defined as the estimate of future demand.

Aggregate planning is carried out once information about future demand is obtained from forecasting.

A poor Aggregate Plan can result in the following:

– Lost sales and profits if unable to meet demand

– A large amount of excess inventory and capacity which increases costs

The question ‘What should the production capacity be such that the total production cost is minimized?’ is known as the aggregate planning problem.

The following costs are used to calculate the minimum production capacity production cost:

– Regular Time cost

– Overtime cost

– Inventory cost

– Shortage cost

The formula for Total Capacity is:

Total Capacity = Regular Time Capacity + Overtime Capacity

Regular time production is assumed to be less costlier than overtime production. Back order cost can be defined as the cost of back ordering per unit per month. Increasing or decreasing the number of production employees does not affect the regular time production capacity.

Linear Programming

R(t) – Regular Time production used in time t

O(t) – Overtime production used in time t

D(t) – Demand during time t

S(t) – Shortage at the end of period t

U(t) – Under utilization in period t

H(t) – Number of people hired in period t

W(t) – Number of people working in period t

L(t) – Number of people laid off in period t

In the linear programming formulation ‘I(t)’ (the inventory at the end of the previous period) has to be defined as a unrestricted variable which can take positive value or a negative value. Linear programming is a method to achieve the best outcome (such as maximum profit or lowest cost) in a mathematical model whose requirements are represented by linear relationships. In aggregate planning the planning horizon is often divided into Periods. The physical resources of the company are assumed to be fixed during the planning horizon of interest.

The following help a company cope with demand fluctuations:

– Changing the size of the work force by hiring and firing.

– Varying the production rate by introducing overtime.

– Accumulating seasonal inventories.

– Planning backorders.

The following costs are relevant to aggregate production planning:

– Basic production costs

– Costs associated with changes in the production rate

– Inventory related costs

In aggregate production planning the following are examples of basic production costs

– Material costs

– Direct labor costs

– Overhead costs

In aggregate production planning the following are costs associated with changes in the production rate:

– Hiring costs

– Training costs

– Laying off personnel costs

In the Aggregate Planning Problem the following are examples of constraints:

– Limits on overtime

– Limits on layoffs

– Limits on capital available

– Limits on stockouts and backlogs

Score

Alison

via Alison.com Platform

03.06.2018

Online Educational Course “Inventory Models – Costs, EOQ Model”

by G. Srinivasan

Inventory Management – Using Inventory Models is the fourth in the Applied Operations Management series of courses. Inventory models help businesses answer the questions: How much material to order? When to order the material? They help firms determine the order quantity that minimizes the total inventory holding costs and ordering costs, as well as the frequency of ordering, to keep goods or services flowing to the customer without interruption or delay.

The course begins by introducing the basics of inventory management and introduces concepts such as deterministic demand and probabilistic demand, type of costs such as cost of item, order cost, and holding or carrying cost. Several models are available to help determine how much inventory should be brought in to restock the products or parts, and you will be introduced to inventory models such as the single period inventory model, the multi-period inventory model and the economic order quantity (EOQ) model. These models are explained in detail using worked examples.

This course will be of great interest to professionals working in the area of inventory management, procurement and operations management and who would like to learn more about using inventory models. The course will also be of interest to learners who are interested in a career in procurement or operations management.

The key points from this module are:

Economic order quantity (EOQ) model is the order quantity that minimizes the total inventory holding costs and ordering costs.

Several extensions can be made to the EOQ model developed by Mr. Pankaj Mane, including backordering costs and multiple items.

The EOQ model solves the “how much” and “when” aspects of ordering inventory. When inventory reaches the zero point, you order just enough to replenish your stock back to its original level.

You repeat this cycle throughout the year, never having to decide when to order or how much to order.

The EOQ model assumes that demand remains steady throughout the year and that inventory gets used at a fixed rate. If those assumptions hold true, you can order at the same time each month or quarter.

However, if demand fluctuates, you may run out of inventory sooner than you anticipate. You also may have to order more than you usually do to meet higher demand, or lower the order to adjust to declining demand.

The EOQ will sometimes change as a result of quantity discounts, which are provided by some suppliers as an incentive for customers to place larger orders.

Score

Alison

via Alison.com Platform

03.06.2018

Online Educational Course “Supply Chain Risk”

by N. Viswanadham

The course Understanding Supply Chain Risk Management (SCRM) introduces the learner to the multitude of risks that threaten the operation of supply chains at national and global levels. A previous course – Understanding Supply Chain Ecosystems – looked at Supply Chain Ecosystems and supply risk involves adverse and unexpected changes to any elements of a supply chain ecosystem.

The aim of SCRM is to reduce supply chain vulnerability by identifying and managing risks within the supply chain and external to it. The course gives examples of resource uncertainties, characteristics of Wicked problems, and describes the elements of a cyber attack. It also lists the six strategies to reduce overall risk exposure.

This course will be of great interest to all professionals who work in the areas of operations management, logistics, procurement and information technology, and to all learners who are interested in developing a career in the area of supply chain management.

Score

Alison

via Alison.com Platform

03.06.2018

Online Educational Course “The Supply Chain Eco-System Framework”

by N. Viswanadham

Supply Chain Ecosystems are made up of a network of organizations, people, activities, information, and resources all of which are involved in moving a product or service from supplier to customer.

The course begins by describing how modern supply chains have evolved into complex international networks, which can no longer be adequately described using the linear concept of a ‘chain’. The course then reviews how modern supply chain ecosystems now comprise of a network of companies, countries and their governments, social and political organisations, natural, industrial (clusters), financial and human resources, delivery infrastructure including logistics and IT, and knowledge of the industrial environment. You will learn how within these ecosystems, each configuration is unique to the particular enterprise that owns that supply chain.

This course will be of great interest to all professionals who work in the areas of operations management, logistics, procurement and information technology, and to all learners who are interested in developing a career in the area of supply chain management.

The key points from this module are:

The Ecosystem Model: A framework to visualize all Operational, Strategic, Management and Execution issues.

Ecosystems comprise of a network of:

Companies, countries and their governments, Social and political organisations

Natural, Industrial (clusters) and Financial and Human resources

Delivery infrastructure including logistics and IT

Connections, and knowledge of the industrial environment.

All interacting together with the landscape and climate (economic and industrial).

Supply chain ecosystems consist of:

Institutions

Resources

Delivery Services infrastructure

Supply Chain

Institutions:

Customs, Export and Other Govt. Regulators

Quality Control and Environmental issues

Social, Financial and Trade issues

Resources:

Infrastructure, Sea ports, Airports, Roads

Industry clusters

Human, Financial and Natural resources and labor unions

Delivery Services infrastructure:

Logistics and IT companies

Transport – Rail, Air, Ship, Road

Logistics parks, SEZs, Freight corridors

Supply Chain:

Retail chains

Distribution

Manufacturing

SuppliersDrivers of Supply Chain Competitiveness

Resources: Labour, Materials and Energy

Government policies and investments on institutional, environmental and infrastructural elements

Delivery mechanisms: Logistics and IT

SES Framework can hep to study:

Governance

Risk

Innovation

Performance

The Five STERM Forces:

Science research

New Technologies

New Engineering materials

Regulations and policies

New Management techniques

Modular Product:

– Made by appropriately combining different modules.

– Provides customers a number of options for each module and thus the product.

– Products differ from each other in terms of the subsets of modules assembled to produce them.

Modular Process:

– Each module undergoes a specified set of operations making it possible to outsource its manufacturing and inventory to them in a semi-finished form.

Part Standardization:

– Common parts are used across many processes

– Products redesigned as necessary

Process Standardization:

– Standardizing as much of the process as possible, making a generic or family product.

– Final product assembly delayed until the customer order is received (i.e. called “postponement”).

Modular Organization Designs

Modularization of product designs paves the way for similar modularization of organization designs facilitting coordination of activities via an “information structure” rather than managerial authority or hierarchy.

The codification of knowledge and standardization (through technical standards and design rules) of the interfaces between organizationally separate stages of production has made vertical specialization (organizational modularity) replace vertical integration.

Types of Resources

Classical economics define:>

– Natural resources

– Human resources

– Financial resources

– Capital assets

Modern view also includes:

– Knowledge, Intellectual property

– Social capital relationships with stake holders

– Management of high value delivery processes

Special Economic Zones (SEZs)

SEZ is a geographical region that has economic laws different from the rest of the country. The goal of SEZs is to attract foreign investments. SEZs have been established in many countries – China, India, Jordan, Poland, Philippines, Russia and North Korea. Indian SEZs are not as effective as those in China probably because they are not as focused.

Clusters

Clusters are geographic concentrations of interconnected companies, specialized suppliers, service providers, and associated institutions (universities, training) in a particular vertical.

Clusters allow companies to operate more productively in sourcing inputs; accessing inforamtion, technology and human resources.

Score

Alison

via Alison.com Platform

29.05.2018

Online Educational Course “Global Supply Chain ReDesign”

by N. Viswanadham

It is said that in today’s market, firms don’t compete, supply chains do, and supply chain design can give supply chains a competitive advantage over competing supply chains. The course begins by explaining what supply chain design is, the importance of supply chain design and the design process itself. You will learn how supply chains determine the ability of the businesses included in them to compete, and the design of their supply chains will affect their ability to compete in the marketplace. For example, a business that is attempting to compete in a market where low cost is paramount will have difficulty if it includes high cost suppliers in its supply chain.

This course will be of great interest to all professionals who work in the areas of operations management, logistics, procurement and information technology, and to all learners who are interested in developing a career in the area of supply chain management. Prerequisites: It is recommended that you have studied the courses ‘Introduction To Supply Chain Management – Revised 2018’, and ‘Understanding Supply Chain Ecosystems – Revised 2018’.

The key points from this module are:

Current day supply chain networks are subjected to disruptions and innovations in the ecosystem elements, resources and other factors.

Disruptions can originate from the banks, governments, bankruptcy of the supplier’s suppliers, natural disasters, piracy, cyber attacks, port strikes and other unknown factors.

Innovations in products, manufacturing and delivery processes, business models, government to government relations such as Free Trade Agreements, regulations and deregulations and many more affect the supply chain.

Global Supply Chain design involves two steps:

1) Global supply chain formation

2) Building Governance mechanisms or frameworks for partner selection, coordination and control

Global Supply Chain Formation:

1) Map the supply chain ecosystem for the industry vertical

2) Formulate the supply chain strategy

3) Select possible locations for the factories

4) Identify the supply chain risks

5) List the feasible supply chain configurations

The Governance Function involves:

Partner selection from group of pre-selected suppliers from Supply Chain Formation stage

Coordination – Determining who does what and when and communicating to everyone

Execution – Build a control tower to monitor order status so that processes work as per plan and control exceptional events

Business Model Innovation (BMI) is a reconfiguration of activities in the existing business model of a firm that is new to the product/service market in which the firm competes.

Clusters are geographic concentrations of interconnected companies, specialized suppliers, service providers, and associated institutions present in a region.

The proximity of companies and institutions in one location fosters better coordination and trust lowering the transactions costs, minimizing the inventory, importing costs and delays.

Types of Supplier Asset Specificity

Physical asset specificity refers to the mobile and physical features of assets such as specific dies, molds, and tooling for the manufacture of a contracted product.

Dedicated asset specificity represents discrete and/or additional investment in generalized production capacity in the expectation of making a significant sale of a product to a particular customer.

Human asset specificity arises in a learning-by-doing fashion through long-standing customer-specific operations.

Site asset specificity refers to the successive stages that are immobile and are located in close proximity to one another so as to economize on inventory and transportation.

Global Competitiveness Indicators – Based on which countries are evaluated include:

– National Policies for Openness in Trade and Markets

– Best Practices for International Trade

– Effective Legal and Enforcement Systems

– Infrastructures for a Global Economy

– Financial Services for Cross-Border Commerce

– Human Capital

Risks to supply chain ecosystems include all possible social, political and environmental risks that may affect the ecosystem and the flows of goods, information and finance.

Risks to Supply Chains:

– Outsourcing

– Mergers or acquisitions

– Large scale and a high degree of concentration

– Political and societal risk

– Resource intensive shortages

Transaction costs include:

Observable costs – Transport costs, import duties, customs tariffs and other formal trade barriers

Soft costs – Costs for information gathering, negotiation and monitoring contracts, trust building, networking, risk handling and mitigation, making up for cultural differences and miscommunication, compliance with safety regulations, labor laws etc.

Three characteristics of transactions affect the transaction costs:

– Asset specificity

– Uncertainty

– Frequency

Transaction Cost Economics (TCE) Theory:

When transaction cost are low, use the spot market governance

When transaction costs are high, hierarchy is efficient

Asset Specificity: Supply chain specific assets, Resources, Institutions, Delivery infrastructure.

Environmental uncertainty can come from suppliers, customers, competitors, regulatory agencies, unions or financial markets.

Frequency of interactions between the buyer and supplier is importance for reasons of economies of scale.

Score

New York Institute of Finance

via Edx.org Platform

13.11.2015

Online Educational Course “Understanding the Federal Reserve “

The course is about the structure and purpose of the Federal Reserve and how its actions impact not just the US economy, and financial institutions, but individual investors and savers alike.

By the end of this course, you will: