Personal exhibition “Active Nature. 10 years of the Unreal Nature as it is”

Personal exhibition “Active Nature. 10 years of the Unreal Nature as it is”

Personal exhibition “Active Nature. 10 years of the Unreal Nature as it is”

2026

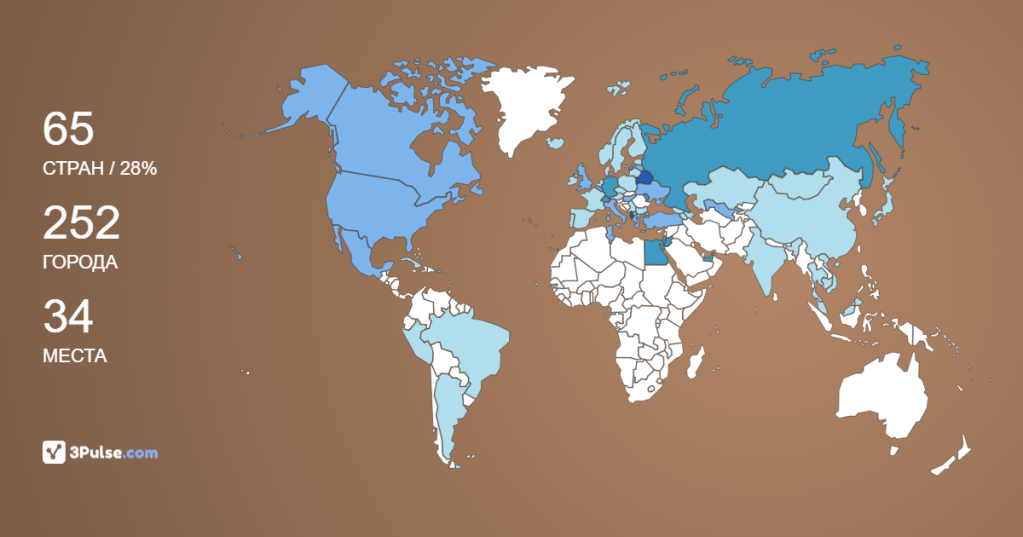

1 World, 10 Seasons, 100+ Trips, 100+ Nature Places, 1000+ Photos, just Episode II

This personal exhibition contains the most interesting photos of beautiful nature views and funny moments of wildlife.

No people. No Zoos. Only Wild Natura.

The full exhibition is here.

Intro

I have always believed that you need to live your life consciously.

If you can do this, at the end of your life it will not hurt you that you didn’t have time to do something.

And everyone must find their own answer to the question of how to do it.

My logical sequence is

- determine what areas your life consists of

- analyze each area

- set goals in each area to achieve them in the future

- spend your resources on achieving these goals

In case of changing life views, you can re-conduct this analysis.

And for me one of my top goals is traveling.

The first episode, which ran for 10 years, was dedicated to cities and countries with their culture and architecture.

The second episode is dedicated to nature and outdoor activities.

Planning

When planning my travels, I chose the way to visit a specific region and explore all the planned places.

My way to find such places is by analyzing the following lists

- Natural Wonders of the World

- UNESCO World Heritage

- Natural sights of the region

- Map of the region

Realization

The rules for a successful travel are

- check visa requirements

- book accommodation and transfers

- buy insurance

- prepare copies of all documents on your smartphone and the Internet

- prepare cash and bank cards

- prepare photo equipment

- check the type of electrical outlets in the region

- have travel apps on your smartphone

- clean up the Feng Shui area in the house, which is responsible for traveling

ActiveNature Seasons

11. Deep Blue

12. Water World

13. Sun of a Beach

14. Ground Floor

15. Fauna Live

16. 3s of Life

17. AquaFalls

18. Rocky 8848

19. Aurora onAir

20. Let’s Go

Top 10 photos

ActiveNature Season 13. Sun of a Beach

ActiveNature Season 13. Sun of a Beach

2025

Interesting and rare moments of everyday life on the best beaches.

Nature

Season 12. Past Bonus

Season 13. Past Bonus

Bali Beach, Maldives Beach, Mauritius Beach, Zanzibar Beach

Season 14. Future Bonus

Season 15. Future Bonus

Season 17. Future Bonus

Season 18. Future Bonus

| Activity | Hobby |

| Shark swimming | F1 Simulator |

| Iguana swimming | Karting |

| Turtle swimming | Football |

| Dolphin swimming | Volleyball |

| Sea lion swimming | Darts |

| Sandboarding | Chess |

| Drift taxi | Golf |

| Maglev | Skateboard |

| Ferris wheel | Drawing |

| Buggy | Dancing |

_

Season 1. Bonus.

City Insight

Belarus: Zembin

_

Place Insight

Resorts: Hampton by Hilton Minsk City Centre

_

Season 3. Bonus.

City Insight

Turkey: Arnavutkoy

_

Season 4. Past Bonus.

Place Insight

Wildlife: Maldives Beach

Season 5. Bonus.

City Insight

Cuba: Havana, Matanzas, Varadero

_

Place Insight

Resorts: Gran Hotel Bristol by Kempinski Havana

Wildlife: Varadero Beach

_

Season 6. Bonus.

City Insight

Argentina: Puerto Iguazu

Brazil: Foz do Iguacu, Indaiatuba, Manaus

Ecuador: Guayaquil, Puerto Ayora, Puerto Baquerizo Moreno, Puerto Villamil

Panama: Panama City

_

Place Insight

Heritage: Easter Island, Nazca lines, Palpa Lines, Panama Canal

National Parks: Rapa Nui

Resorts: Courtyard by Marriott Santiago

Wildlife: Amazon, Andes, Galapagos, Iguazu

_

Season 7. Bonus.

City Insight

Ethiopia: Addis Ababa

_

Place Insight. Past Bonus

Wildlife: Mauritius Beach, Zanzibar Beach

_

Season 8. Past Bonus.

Place Insight

Wildlife: Bali Beach

_

Stats: Countries 5 (93), Cities 20 (460), Events 0 (65), Places (HandMade+Nature) 17 (118), Activity 10 (30), Hobby 10 (30)

AI Procurement. Comparison of Traditional vs. Philosophy-Inspired Supply Chain Approaches

AI Procurement

Comparison of Traditional vs. Philosophy-Inspired Supply Chain Approaches

10.01.2025

Traditional Approach

Core Philosophy: Maximize efficiency, minimize cost, optimize shareholder value

Key Characteristics:

- Transactional supplier relationships

- Cost-driven decision making

- Just-in-time inventory (minimal buffers)

- Standardized, scalable processes

- Hierarchical control structures

- Risk transfer to suppliers

- Key metrics: Cost savings, ROI, on-time delivery

Pros:

- Predictable, measurable outcomes

- Scalable across global operations

- Proven frameworks and technologies

- Clear accountability structures

- Efficient in stable environments

Cons:

- Fragile during disruptions

- Human elements often overlooked

- Sustainability as add-on, not core

- Innovation stifled by standardization

- High burnout rates in operations

Philosophy-Inspired Approaches Comparison

| Philosophy | Core Focus | Procurement/SCM Application | Pros | Cons |

|---|---|---|---|---|

| Ikigai | Purpose-driven balance | Align processes with meaning, mission, profit | – Holistic value creation – Strong employee engagement – Balanced metrics |

– Can dilute financial focus – Complex to measure “purpose” |

| Lagom | “Just the right amount” | Balanced inventory, fair relationships, sustainable sourcing | – Resilient buffers – Sustainable by design – Reduces waste |

– May appear “unambitious” – Hard to quantify “enough” |

| Hygge | Comfort & human connection | Trust-based partnerships, pleasant work environments | – Strong supplier loyalty – Low team turnover – Collaborative innovation |

– May slow tough decisions – Could enable complacency |

| Sisū | Grit & resilience | Extreme preparedness, crisis-hardened networks | – Unbreakable during disruptions – Innovative under pressure – Strong crisis leadership |

– Risk of burnout – Can over-invest in redundancy |

| Ubuntu | Interconnected humanity | Community-centric sourcing, stakeholder inclusion | – Deep social license to operate – Unparalleled local resilience – Ethical brand strength |

– Highest cost structure – Complex stakeholder management |

| Wabi-Sabi | Embracing imperfection | Flexible systems, natural variation acceptance | – Adapts beautifully to flux – Reduces perfectionism waste – Authentic sustainability |

– Challenges quality standards – Difficult to scale uniformly |

| Jugaad | Frugal innovation | Resource-constrained problem solving | – Extreme cost efficiency – Hyper-local adaptability – Rapid crisis response |

– Quality control challenges – Difficult to systematize |

Effectiveness Analysis

Which is “More Effective”?

The answer depends entirely on the company’s context:

1. For Multinationals in Stable Markets:

- Primary: Traditional + Lagom hybrid

- Why: Maintains efficiency while adding resilience buffers and sustainability

- Effectiveness: High for predictable ROI with reduced disruption risk

2. For Socially-Conscious Brands:

- Primary: Ubuntu + Ikigai fusion

- Why: Authentic alignment with ethical consumer expectations

- Effectiveness: Creates powerful brand differentiation and loyalty

3. For Operations in Volatile Regions:

- Primary: Jugaad + Sisū combination

- Why: Maximizes survival and adaptation in constrained environments

- Effectiveness: Exceptional for maintaining operations against odds

4. For Luxury/Artisanal Businesses:

- Primary: Wabi-Sabi + Hygge blend

- Why: Values craftsmanship, story, and human relationships

- Effectiveness: Creates premium perceived value and customer connection

5. For Post-Crisis Recovery:

- Primary: Sisū + Jugaad with Ikigai

- Why: Combines resilience, resourcefulness, and renewed purpose

- Effectiveness: Rapid rebuilding with stronger foundations

Integrated Framework: The “Adaptive Purpose” Supply Chain

Most effective approach for the 21st century company:

Core Architecture:

1. Purpose Foundation (Ikigai) – Why do we exist beyond profit?

2. Balanced Operations (Lagom) – “Just right” inventory, partnerships, growth

3. Human Core (Hygge/Ubuntu) – Trust, dignity, and well-being at center

4. Resilience Layer (Sisū) – Grit and preparedness for disruptions

5. Adaptive Mindset (Wabi-Sabi/Jugaad) – Flexibility and frugal innovation

Implementation Strategy:

Stage 1: Traditional efficiency (financial viability)

Stage 2: + Lagom balance + Hygge relationships (stability)

Stage 3: + Ubuntu ethics + Ikigai purpose (meaning)

Stage 4: + Sisū resilience + Wabi-Sabi flexibility (adaptation)

Stage 5: + Jugaad innovation (thriving in constraints)

Pros of This Blended Approach:

- Addresses financial, social, environmental, and operational needs

- Creates both efficiency and resilience

- Attracts talent and builds brand across stakeholder groups

- Functions well in both stable and volatile conditions

- Continuously evolves through learning

Cons:

- Extremely complex to implement and measure

- Requires exceptional leadership and cultural maturity

- May face investor skepticism about “soft” metrics

- Integration challenges between conflicting priorities

Conclusion: The Evolution of Effectiveness

Traditional approaches are no longer sufficient in a world of climate disruption, pandemics, social inequality, and geopolitical volatility. However, pure philosophy-based approaches often lack the financial discipline required for survival.

The most effective modern supply chain is a hybrid: It begins with traditional financial discipline but layers on purpose (Ikigai), balance (Lagom), humanity (Ubuntu/Hygge), resilience (Sisū), and adaptive creativity (Wabi-Sabi/Jugaad) in proportions appropriate to the business context.

Effectiveness Metric Shift:

- Past: Cost savings + On-time delivery

- Present: Resilience + Sustainability + Profit

- Future: Regenerative impact + Stakeholder well-being + Adaptive innovation + Financial health

The company that masters contextual integration of these philosophies—knowing when to apply which principles—will build not just a supply chain, but a living business ecosystem that thrives through whatever challenges the 21st century presents. This requires moving from “either/or” thinking to “both/and” thinking—where a supply chain can be both efficient AND humane, both profitable AND purposeful, both standardized AND adaptable.

Final verdict: No single philosophy is “most effective.” The future belongs to philosophically intelligent organizations that can dynamically apply the right principles to the right situations, creating supply chains that are as wise as they are efficient.

AI Procurement. How can a company build its procurement and supply chain processes using the Jugaad philosophy?

AI Procurement

How can a company build its procurement and supply chain processes using the Jugaad philosophy?

09.01.2025

Integrating the Indian philosophy of Jugaad (pronounced joo-gaardh) — meaning “frugal innovation” or “the art of improvising effective solutions with limited resources” — into procurement and supply chain processes can create a culture of agility, resilience, and grassroots ingenuity.

Unlike top-down, capital-intensive optimization models, Jugaad is about flexibility, simplicity, and making things work in constrained, unpredictable environments.

Core Principles of Jugaad in Business

1. Do More with Less – Maximize resource efficiency and minimize waste.

2. Embrace Simplicity – Seek elegant, minimal, and accessible solutions over complex ones.

3. Think and Act Flexibly – Be agile and adapt quickly to changing constraints.

4. Include the Marginal – Innovate for and with underserved or constrained contexts.

5. Follow Your Heart – Passion and intuitive problem-solving drive action.

6. Learn Through Trial & Error – Experiment rapidly and learn from failure.

Practical Application to Procurement & Supply Chain

1. Supplier Strategy: Leveraging Grassroots & Frugal Partners

- Source from “Jugaad Entrepreneurs” – Actively seek out small, local, or informal sector suppliers who excel at frugal innovation. They often create robust, low-cost solutions perfect for emerging markets or resilient backup sourcing.

- Co-Innovate with Suppliers on Constraints – Challenge suppliers with clear constraints (e.g., “Reduce packaging cost by 30% without compromising protection”) and reward innovative, simple solutions.

- Develop Local “Micro-Supply Hubs” – Instead of relying solely on large centralized suppliers, create networks of local small suppliers who can respond quickly with flexible capacity.

2. Inventory & Logistics: Frugal & Adaptive Systems

- Create “Good Enough” Buffer Solutions – Use low-cost, locally available materials for packaging or in-house storage solutions (e.g., repurposed containers, modular DIY racks) instead of expensive custom systems.

- Flexible, Multi-Use Assets – Invest in logistics assets that can serve multiple purposes (e.g., vehicles that can handle different load types, modular containers).

- Last-Mile Jugaad – In challenging delivery environments (e.g., rural areas, dense urban markets), partner with local informal logistics networks (bicycle couriers, tuk-tuks, boat networks) who can navigate constraints creatively.

3. Process Design: Simplification & Improvisation

- “Minimum Viable Process” Approach – For non-critical procurement categories, design extremely simple, low-admin processes (e.g., delegated spot buying with basic guidelines) instead of over-engineered systems.

- Empower Frontline Improvisation – Train and trust procurement & logistics staff to solve problems on the ground with available resources (within ethical/legal boundaries). Celebrate stories of clever fixes.

- Low-Tech Digital Solutions – In areas with poor IT infrastructure, use lightweight tools like WhatsApp groups for supplier coordination, SMS-based tracking, or simple mobile apps instead of expensive, complex ERP extensions.

4. Risk Management & Resilience: Frugal Redundancy

- Build a “Jugaad Network” of Backup Options – Identify alternative materials, components, or routes that are less ideal but “good enough” in a crisis. Often these are local, slower, or non-standard but reliable under disruption.

- Cross-Train for Flexibility – Ensure team members can handle multiple roles (sourcing, logistics, basic quality checks) to maintain operations during shortages or absences.

- Design for Repair & Reuse – Procure equipment and assets that are easy to fix locally with generic parts, reducing downtime and dependence on expensive specialized service contracts.

5. Sustainability & Cost Innovation

- Waste-to-Value Initiatives – Apply Jugaad thinking to turn supply chain waste into resources (e.g., using pallet wood for in-house repairs, converting damaged goods into by-products).

- Frugal Automation – Instead of large-scale robotics, implement simple, low-cost automation (e.g., gravity-fed racks, manual conveyor improvements) that enhances productivity without major capex.

- Constraint-Driven Green Solutions – Use resource constraints (e.g., water scarcity, high energy costs) as drivers for innovative, low-cost sustainable practices.

Example: A Consumer Goods Company in Emerging Markets Applying Jugaad

- Procurement: Sources packaging from local small producers who make boxes from recycled agricultural waste, cutting costs and carbon.

- Production: Uses flexible, multi-skilled local labor to run small batch production lines that can quickly switch between products based on material availability.

- Distribution: For rural distribution, uses a hybrid model — trucks to regional hubs, then a network of motorized rickshaws with custom racks for last-mile delivery.

- Maintenance: Trains local technicians to repair factory equipment using 3D-printed parts and locally sourced components, avoiding expensive imported spare parts.

- Crisis Response: During a sudden border closure, the logistics team quickly partners with a local boat operator to move critical shipments via river routes at 1/10th the cost of air freight.

Contrast with Traditional Models

- Traditional: “Perfect solution” – Requires extensive planning, capital, and ideal conditions.

- Jugaad-Inspired: “Workable solution” – Focuses on speed, adaptability, and making the most of what’s available now.

Strategic Advantages of a Jugaad Supply Chain

1. Extreme Cost Efficiency – Reduces both capex and opex through frugal innovation.

2. Hyper-Local Adaptability – Solutions are tailored to local constraints and opportunities.

3. Rapid Crisis Response – Culture of improvisation enables quick adaptation to disruptions.

4. Inclusive Growth – Engages and develops local suppliers and communities.

5. Sustainable Innovation – Naturally promotes resource conservation and circular thinking.

Implementation Roadmap

1. Identify “Constraint Hotspots” – Map where your supply chain faces the biggest resource, infrastructure, or cost constraints.

2. Launch Jugaad Challenges – Run internal and supplier competitions to solve specific problems with limited budgets (e.g., “Reduce packaging weight by 40% with under $500 investment”).

3. Create a Jugaad Toolkit – Develop simple guidelines for ethical improvisation (what’s allowed, what’s not) and share best practices across teams.

4. Celebrate & Reward Frugal Innovation – Recognize employees and suppliers who deliver clever, low-cost solutions.

5. Build Local Innovation Ecosystems – Partner with universities, startups, and informal sector networks to source Jugaad solutions.

Caveats & Balance

Jugaad must be guided by ethical boundaries and quality guardrails. It is not about cutting corners that compromise safety, ethics, or long-term value. The goal is frugal ingenuity, not reckless improvisation.

When balanced with robust governance, Jugaad transforms from a survival tactic into a strategic capability — enabling companies to operate profitably in volatile environments while building extraordinary resilience from the ground up.

Final Thought

In an era of constant disruption and resource constraints, Jugaad moves supply chain thinking from “How do we optimize perfect conditions?” to “How do we thrive in imperfect reality?” It cultivates the entrepreneurial spirit at every level of the supply chain, turning constraints into catalysts for innovation.

AI Procurement. How can a company build its procurement and supply chain processes using the Wabi-Sabi philosophy?

How can a company build its procurement and supply chain processes using the Wabi-Sabi philosophy?

08.01.2025

Integrating the Japanese Wabi-Sabi philosophy—centered on embracing imperfection, transience, and the beauty of the natural, weathered, and incomplete—into procurement and supply chain processes offers a profound counterpoint to modern industry’s obsession with flawless efficiency, hyper-optimization, and sterile predictability.

Wabi-Sabi teaches us to find value in authenticity, simplicity, and the graceful acceptance of limits and flux.

Core Principles of Wabi-Sabi in a Business Context

1. Imperfection is Inevitable & Informative – Flaws are not failures; they are evidence of nature, process, and uniqueness.

2. Nothing is Finished or Permanent – Everything is in a state of becoming or decay; processes should be adaptable and designs flexible.

3. Asymmetry & Irregularity – Natural, non-uniform patterns are more resilient and interesting than forced symmetry.

4. Simplicity & Austerity – Strip away the non-essential to reveal the true, functional essence.

5. Appreciation of the Weathered & Weathered – Value signs of use, repair, and the patina of time; they tell a story of journey and resilience.

Practical Application to Procurement & Supply Chain

1. Supplier Relationships: Embracing Human & Natural Imperfection

- Value Authenticity Over Polished Presentations – Choose suppliers who are transparent about their limitations and challenges, not just those with flawless marketing. A supplier who openly discusses their water scarcity challenges may be a more authentic, improvement-focused partner.

- Long-Term “Weathering” Together – View supplier relationships as evolving and maturing over time, gaining strength from shared history and recovered disruptions (like the repaired cracks of kintsugi).

- Asymmetric Partnerships – Not all relationships need to be perfectly balanced or identical. Nurture deep, collaborative partnerships with a few key suppliers (embracing their unique, “imperfect” capabilities) alongside a broader, simpler network for flexibility.

2. Inventory & Planning: Accepting Flux and Incompleteness

- Forecasting as a “Living Practice,” Not a Perfect Science – Acknowledge the inherent impossibility of perfect forecasts. Build adaptive, human-in-the-loop planning systems that respond to flux gracefully, rather than punishing planners for “inaccurate” predictions.

- Buffer as “Breathing Space” – Instead of seeing safety stock as waste, view it as the essential “negative space” (a key Wabi-Sabi concept) that allows the system to breathe and absorb shocks naturally.

- Manage by Exception & Nuance – Don’t seek to control every SKU with the same rigid, perfect algorithm. Allow human judgment to handle the unique, the irregular, and the exceptional items.

3. Quality & Materials: The Beauty of the Natural & Unfinished

- Source for Character & Story – In select product lines, intentionally source materials that show natural variation (e.g., undyed wool, wood with visible grain, leather with scars). This tells a story of authenticity that consumers value.

- Design for Patina & Repair – Procure components that age gracefully and are easily repairable. This shifts the focus from “like-new” perfection to long-term character and ownership.

- Accept “Good Enough” Functional Quality – For non-critical components, specify acceptable performance ranges rather than untenably tight tolerances. This reduces cost, waste, and supplier stress without compromising end-use.

4. Process Design: Simplicity, Austerity, and Human Touch

- Simplify Relentlessly – Apply the principle of austerity (koko) to processes. Audit procurement workflows and strip away redundant approvals, unnecessary reports, and over-engineered IT systems. Seek elegant, minimal process solutions.

- Value the “Artisan” in the System – Recognize and elevate the role of experienced buyers, planners, and logistics experts whose tacit knowledge and intuition (honed over time) handle nuance better than any algorithm. Their expertise is the “patina” of the process.

- Make Imperfections Visible & Informative – Instead of hiding process breakdowns, display them on andon boards or in team huddles as opportunities for mindful reflection and gentle improvement (kaizen in a Wabi-Sabi spirit).

5. Logistics & Delivery: The Poetry of Transience

- Embrace “Good Enough” Routing – Optimize transportation not for theoretical perfection, but for robust, flexible solutions that accommodate real-world variability (traffic, weather, driver availability).

- Use Return Loops & Packaging Cycles – See the beauty in circular, reusable packaging systems that gain character with each trip. A scratched but sturdy returnable container is more beautiful in its purpose than a pristine, single-use box.

- Accept the Patina of Use – In fleet management, maintain vehicles for safety and function, but don’t stress over minor aesthetic wear. It evidences a life of valuable service.

Example: A Furniture Company Applying Wabi-Sabi

- Procurement: Sources wood from forests practicing sustainable thinning, specifically selecting wood with knots, burls, and natural color variations as a mark of authenticity, not a defect to be hidden.

- Inventory: Keeps a modest stock of “character” wood for custom pieces, accepting that it is a finite, transient resource that will create unique, non-repeatable products.

- Design & Manufacturing: Builds furniture using joinery that allows for wood movement and future disassembly/repair. Offers a visible kintsugi-inspired repair service for damaged pieces.

- Quality Control: Trains inspectors to distinguish between structural flaws (which are rejected) and natural character marks (which are celebrated and documented for the customer).

- Team Mindset: Planning meetings begin with a reflection on a recent “imperfection” or unexpected event, discussing what it reveals about the system’s true nature and what can be learned—without blame.

Contrast with Traditional Models

- Traditional Lean/Six Sigma: Seeks to eliminate variation and defects, pursuing a state of sterile, controlled perfection.

- Wabi-Sabi-Inspired: Seeks to understand, harmonize with, and find value in natural variation and imperfection. It aims for robust, adaptive, and meaningful systems, not flawless ones.

Strategic Advantages of a Wabi-Sabi Supply Chain

1. Resilience Through Acceptance – By designing for flux and imperfection, the system becomes inherently more adaptable to shocks.

2. Reduced Waste & Stress – Eliminates the enormous cost and energy spent chasing the last 1% of “perfection” in forecasts, specifications, and efficiency.

3. Authentic Brand Narrative – Provides a powerful, genuine story of craftsmanship, sustainability, and mindful consumption.

4. Enhanced Innovation – Freedom from the tyranny of “perfect” allows for experimentation with asymmetric, simple, and unconventional solutions.

5. Human-Centric Work Culture – Reduces burnout by valuing wisdom and judgment over robotic precision, and by accepting that human processes are beautifully imperfect.

Implementation Steps

1. Reframe “Failure” – Lead a cultural shift to view deviations and surprises as sources of information and beauty, not merely failures.

2. Conduct a “Simplicity Audit” – Identify the most over-engineered, complex, or stressful process in procurement/supply chain and challenge teams to design a simpler, more forgiving version.

3. Launch a “Wabi-Sabi Pilot” – Choose one product line or supplier relationship to operate under new principles: accept natural material variations, build in flexible timelines, and document the story.

4. Develop New Aesthetic & Functional Standards – Co-create with designers and suppliers new guidelines that define the “beautifully acceptable” range for materials and processes.

5. Celebrate “Kintsugi Moments” – Publicly recognize and reward teams who beautifully recover from a disruption, leaving the system stronger and with a visible “seam of gold.”

Final Reflection

A Wabi-Sabi supply chain does not advocate for sloppiness or low standards. It advocates for wisdom in distinguishing between a harmful defect and a beautiful imperfection; between rigid fragility and flexible resilience.

It reminds us that supply chains are living, human-driven systems existing in a natural world of cycles, decay, and rebirth. By embracing asymmetry, transience, and rustic simplicity, we can build networks that are not only more robust and sustainable but also more humane and meaningful. The goal shifts from building a perfect machine to nurturing a vibrant, adaptive ecosystem that ages with grace and character.

AI Procurement. How can a company build its procurement and supply chain processes using the Ubuntu philosophy?

AI Procurement

How can a company build its procurement and supply chain processes using the Ubuntu philosophy?

07.01.2025

AI Procurement. How can a company build its procurement and supply chain processes using the Sisū philosophy?

AI Procurement

How can a company build its procurement and supply chain processes using the Sisū philosophy?

06.01.2025

Integrating the Finnish concept of Sisū (pronounced see-soo)—the inner strength, grit, and relentless perseverance in the face of overwhelming adversity—into procurement and supply chain processes offers a powerful framework for building extreme resilience, adaptability, and a culture of tenacity.

Unlike philosophies focused on balance or comfort, Sisū is about action, fortitude, and pushing through the impossible with quiet determination.

Core Principles of Sisū in a Business Context

1. Resilience Beyond Measure – The ability to endure and recover from severe setbacks.

2. Action-Oriented Grit – Not just enduring, but proactively pushing forward against odds.

3. Mental Toughness & Perseverance – Sustaining effort despite fatigue, failure, or ambiguity.

4. Silent Determination – Less talk, more doing; solving problems without fanfare.

5. Adaptability in Crisis – Transforming obstacles into opportunities through sheer will.

Practical Application to Procurement & Supply Chain

1. Supplier Relationships: Forged in Adversity

- Select for Resilience, Not Just Cost – Choose suppliers who have demonstrated their own sisū—survived crises, innovated under constraint, shown ethical grit. Audit not just for compliance, but for crisis character.

- Co-develop Contingency Plans with Grit – Work with key suppliers to create “unbreakable” protocols for black-swan events. Test them under simulated extreme stress (e.g., cyber-attack drills, sudden sanctions, natural disasters).

- Long-Term “All-Weather” Partnerships – Commit to suppliers who stay with you through volatility, rewarding loyalty and shared perseverance over opportunistic switching.

2. Inventory & Risk Strategy: The Preparedness of Sisū

- Strategic Redundancy as a Mindset – Hold critical buffers not as waste, but as determined preparedness. Identify single points of failure and build resilient alternatives—even if they cost more.

- Transparency and Honesty About Vulnerabilities – Foster a culture where teams can flag extreme risks without blame, then tackle them with collective grit.

- Decentralized Stocking for Autonomy – Empower regional teams to hold survival stock for local contingencies, trusting their on-ground sisū to manage it wisely.

3. Logistics & Crisis Response: The Action of Sisū

- Develop “First-Responder” Logistics Networks – Pre-qualify backup carriers, charter options, and unconventional routes. Train logistics teams in crisis decision-making under pressure.

- Embrace Extreme Flexibility – When a port shuts down, a sisū-inspired team doesn’t just wait—they reroute through smaller ports, use rail, break bulk, and work around the clock to keep goods moving.

- Invest in Low-Tech Redundancies – Sometimes grit means having a low-tech fallback when high-tech systems fail (e.g., paper-based tracking, local radio networks for coordination).

4. Team Culture & Mindset

- Train for Mental Toughness – Use stress inoculation: simulations, war games, and scenario planning that push teams to their limits in a controlled environment.

- Celebrate “Grit Stories,” Not Just Success Stories – Recognize teams who fought through a supply crisis, even if the outcome wasn’t perfect. Honor effort, ingenuity, and perseverance.

- Lead with Calm Determination – Leaders model sisū by staying focused and resilient during disruptions, avoiding panic, and projecting steadfast resolve.

5. Sustainable Grit: Endurance for the Long Haul

- Build Physical & Digital Durability – Source components and choose IT systems not just for efficiency, but for ruggedness and longevity. Favor repairability over disposability.

- Invest in Supplier Development in Tough Regions – Sometimes sisū means helping a strategic supplier in an emerging market overcome local infrastructural hurdles—building roads, securing power—to create an unshakeable partner.

- Promote Well-being to Sustain Grit – True sisū is not about burnout. It’s about cultivating deep reserves. Encourage recovery, mental health support, and work-life balance so teams can tap into their fortitude when truly needed.

Example: An Electronics Manufacturer Applying Sisū

- Supplier Selection: Chooses a ruggedized component supplier from a Nordic country known for surviving economic crises, rather than the cheapest Asian option. They pay a premium for supplier resilience.

- Risk Mitigation: Identifies a rare-earth mineral dependency. Instead of accepting the risk, the procurement team relentlessly pursues a recycling partnership and funds a startup exploring alternatives—a 10-year sisū project.

- Disruption Response: When a hurricane halts shipping, the logistics team works 72 hours straight, coordinating airlifts from three alternate airports, communicating via satellite phones when networks fail.

- Team Culture: Quarterly “stress tests” where teams are given an impossible supply chain problem to solve in 4 hours. No bonuses for winning—just respect for the grit shown.

Contrast with Other Philosophies

- Lagom (Balance): “Find the right amount.”

Sisū (Grit): “Endure any amount, and push beyond.” - Hygge (Comfort): “Create cozy security.”

Sisū (Grit): “Operate effectively in discomfort.” - Ikigai (Purpose): “Find joy in being.”

Sisū (Grit): “Find strength in persisting.”

Sisū complements these—it’s the backbone that upholds balance, protects comfort, and serves purpose when the world gets tough.

Implementation Roadmap

1. Crisis Audit – Identify past breakdowns and ask, “Did we show sisū? Where did we break?”

2. Define “Grit Metrics” – Track recovery time from disruptions, supplier survival rates, employee resilience scores.

3. Train for Tenacity – Invest in crisis leadership programs, mental toughness workshops, and scenario-based drills.

4. Reward Resilience – Include sisū behaviors in performance reviews: “How did you handle a major setback this year?”

5. Communicate the Philosophy – Share stories of Finnish sisū (Winter War, etc.) to embed the concept in culture.

The Strategic Advantage of a Sisū Supply Chain

In an age of constant disruption—pandemics, climate events, trade wars, cyber-attacks—a supply chain built on sisū transforms vulnerability into durability. It becomes:

- Unbreakable by design – because it’s prepared to bend and not snap.

- A talent magnet – for problem-solvers who thrive on challenge.

- A competitive moat – because competitors with fragile, efficiency-only chains will fail in crises where your sisū-chain persists.

- Ultimately more sustainable – because what endures wastes less.

Sisū reminds us that the goal is not just to avoid failure, but to build the inner fortitude to withstand, adapt, and advance no matter what the world throws at the supply chain. It’s not a tactic, but a cultural DNA—the quiet confidence that when all else fails, your people and processes will find a way through.

AI Procurement. How can a company build its procurement and supply chain processes using the Hygge philosophy?

AI Procurement

How can a company build its procurement and supply chain processes using the Hygge philosophy?

05.01.2025

Integrating the Hygge (pronounced “hoo-ga”) philosophy—the Danish concept of coziness, comfort, connection, and mindful well-being—into procurement and supply chain processes may seem abstract at first, but it offers a powerful human-centric lens to build trust, resilience, and quality into the backbone of a business.

Here is how a company can embed Hygge’s core principles into procurement and supply chain design.

Core Principles of Hygge in a Business Context

1. Atmosphere & Comfort – Creating a warm, safe, pleasant environment.

2. Presence & Mindfulness – Being in the moment, focusing on the human experience.

3. Togetherness & Trust – Nurturing genuine relationships and shared experiences.

4. Simplicity & Moderation – Avoiding overcomplication, appreciating the ordinary.

5. Gratitude & Contentment – Finding satisfaction in what you have and who you work with.

Practical Application to Procurement & Supply Chain

1. Supplier Relationships: From Transactions to “Hygge Partnerships”

- Long-term, cozy relationships over short-term gains – Choose suppliers you genuinely enjoy working with, who share values of fairness and well-being. Visit them, share meals, build personal connections (togetherness).

- Fair negotiations – Aim for agreements where both sides feel respected and comfortable, not squeezed. A Hygge negotiation seeks mutual contentment, not one-sided victory.

- Transparent communication – Create open, blame-free channels for dialogue—like a “cozy virtual fireside chat” regular check-in instead of just rigid performance reviews.

2. Work Environment for Procurement & Planning Teams

- Physical & digital workspace comfort – Ensure procurement teams have pleasant, calming workspaces (natural light, plants, warm lighting). Reduce stressful, frantic digital dashboards; design analytics tools that are clear, simple, and helpful.

- Mindful meetings – Start supplier or internal meetings with a personal check-in. Encourage presence—no multi-tasking. Perhaps even have a virtual “coffee/tea together” moment.

- Celebrate small wins – Acknowledge successful deliveries, resolved issues, or positive supplier feedback with small rituals (e.g., a team cake, a thank-you note). Gratitude strengthens bonds.

3. Process Design: Simple, Robust, and Stress-Reducing

- Simplicity in systems – Avoid over-engineered, complex approval workflows. Create processes that are intuitive and reduce anxiety—like clear guidelines, fewer bureaucratic steps.

- Buffer as comfort – Unlike extreme lean/JIT, incorporate reasonable buffers in inventory or lead times to reduce stress on teams and suppliers. This is the supply chain equivalent of having a cozy blanket for a cold night—it provides comfort and security.

- Predictable rhythms – Establish steady, predictable ordering cycles where possible, so suppliers can plan comfortably. Chaos and constant firefighting are anti-Hygge.

4. Quality & Sustainability: The Comfort of Good Conscience

- Source materials that feel good – Prioritize sustainable, ethically sourced materials that align with the comfort of knowing you’re doing good. This enhances brand atmosphere for the end customer too.

- Products that last and comfort – In procurement for product-based companies, choose components that ensure durability and quality—creating a sense of long-term contentment for the user.

- Local sourcing where possible – Shorter, more personal supply chains often align with Hygge’s emphasis on community and trust. Knowing your local supplier personally adds togetherness.

5. Logistics & Delivery: A Calm, Reliable Experience

- Stress-free delivery for partners – Offer flexible but clear delivery windows for carriers, treat drivers with warmth (provide a comfortable waiting area, refreshments).

- Packaging that feels good – Use simple, aesthetically pleasing, and functional packaging—unboxing should evoke a sense of care, not frustration with excess plastic and complexity.

- Transparency for customers – Provide clear, honest tracking without overpromising. Under-promise and over-deliver to create a feeling of reliable comfort.

Example: A Furniture Company Applying Hygge

- Procurement: Sources wood from a family-owned Nordic forest supplier they’ve visited regularly. They negotiate fair prices allowing the supplier to invest in worker well-being.

- Planning: Keeps a moderate buffer of popular fabric rolls to avoid last-minute panic and allow designers creative freedom.

- Team Culture: The planning team starts Mondays with a 15-minute coffee chat to share weekend highlights. They have candles (LED for safety) and soft lighting in their office.

- Logistics: Uses unbleached recycled paper packaging that is simple to open. Delivery drivers are offered a hot drink in winter during pickup.

- Supplier Relationships: Hosts an annual “Hygge Supplier Day” with shared lunch, feedback sessions, and collaborative planning in a relaxed setting.

Contrast with Traditional Models

- Traditional: Emphasizes cost, speed, efficiency, often at the expense of human elements.

- Hygge-Inspired: Emphasizes trust, comfort, simplicity, and mutual well-being as foundations for long-term efficiency and resilience.

Benefits of a Hygge-Inspired Supply Chain

1. Enhanced Supplier Loyalty & Innovation – Suppliers treated as cozy partners will go the extra mile, share ideas, and prioritize your needs during shortages.

2. Reduced Team Burnout – A calm, pleasant work environment increases retention and reduces errors caused by stress.

3. Greater Resilience – Trust-based relationships and buffers provide natural shock absorbers during disruptions.

4. Brand Alignment – For consumer-facing brands, a supply chain rooted in care and comfort can be a authentic storytelling point.

5. Sustainable by Nature – Simplicity, local focus, and ethical sourcing align with environmental and social goals.

Implementation Steps

1. Start with the team – Introduce Hygge principles internally. Create cozy spaces and rituals.

2. Map “moments of stress” in the procurement cycle and redesign them for comfort—e.g., painful RFP processes, chaotic inbound logistics.

3. Choose one key supplier relationship to transform using Hygge principles—deepen communication, express gratitude, negotiate with well-being in mind.

4. Incentivize differently – Reward procurement staff for relationship quality and sustainability metrics, not just cost savings.

5. Measure cultural metrics – Supplier satisfaction scores, team well-being, reduced emergency orders.

Final Thought

Hygge in supply chain is not about adding fluffy blankets to warehouses (though it doesn’t hurt). It’s about designing processes and relationships that create a sense of security, trust, and human warmth. In a world of volatility and transactional pressure, a Hygge-inspired supply chain can become a rare competitive advantage: a resilient, humane network where people genuinely want to work together, fostering quality and innovation naturally.

It’s the art of making the heart of operations feel like a safe, welcoming hearth rather than a cold, relentless machine.

AI Procurement. How can a company build its procurement and supply chain processes using the Lagom philosophy?

AI Procurement

How can a company build its procurement and supply chain processes using the Lagom philosophy?

04.01.2025

Integrating the Swedish concept of Lagom (pronounced lah-gom), meaning “not too little, not too much” or “just the right amount,” into procurement and supply chain processes offers a profound shift towards balanced, sustainable, and resilient operations.

Lagom is fundamentally about moderation, fairness, sustainability, and collective well-being. It rejects excess, waste, and aggressive optimization at the expense of people or the planet.

Here is how a company can build its procurement and supply chain processes using the Lagom philosophy:

Core Principles of Lagom in Supply Chain

1. Balance & Moderation: Avoid extremes. Not just-in-time to the point of fragility, not overstocked to the point of waste.

2. Sustainability & Resourcefulness: Use only what is needed. Design for longevity and minimal waste.

3. Fairness & Equity: Treat all partners (suppliers, employees, communities) with respect and fairness.

4. Functionality & Quality: Prioritize “fit for purpose” and durability over flashy excess.

5. Collective Good: Decisions should benefit the entire ecosystem, not just the company’s bottom line.

Practical Application Across the Supply Chain

1. Strategic Sourcing & Supplier Selection

- “Just the Right” Partners: Move beyond price-only auctions. Select a balanced portfolio of suppliers—a mix of large (for scale) and small/local (for resilience and community benefit).

- Fair Relationships: Negotiate for fair prices that allow suppliers a healthy margin to invest in their workers and innovation. This is the opposite of squeezing them to the last penny.

- Long-term Collaboration: Prefer fewer, deeper partnerships (Lagom number) over a vast, fragmented base. This fosters trust, quality, and joint problem-solving.

- Transparency: Share forecasts and challenges appropriately, seeking a balanced view of risk and opportunity.

2. Inventory & Demand Planning

- “Just the Right” Inventory: Employ demand-sensing and advanced forecasting to avoid both stockouts and bloated warehouses. Aim for the balanced point where service level costs and holding costs are in equilibrium.

- Buffer Stock as a Thoughtful Choice: Hold moderate, strategic buffers for critical items, not as waste, but as a prudent investment in resilience (a Lagom buffer).

- Embrace Circularity: Design processes for repair, refurbishment, and take-back. This is the ultimate “not too much” for raw material extraction.

3. Logistics & Transportation

- Right-Sized Shipping: Optimize container and truckload fill rates to be “just full”—maximizing space without overloading. Consolidate shipments.

- Balanced Modal Mix: Choose the most appropriate (not just the fastest or cheapest) transport mode. Could a slower sea freight be “just right” for the environmental cost saved?

- Green Logistics: Invest in electric vehicles or carbon offset programs to achieve a “balanced footprint”—neutralizing the unavoidable impact.

4. Packaging & Materials

- Minimalist, Functional Packaging: Use the minimum material required to protect the product. Innovate with reusable, returnable, or compostable packaging.

- Design for Disassembly: Source and design products so components can be easily separated and recycled at end-of-life.

5. Performance Metrics (KPIs)

Shift from extreme, single-focus KPIs to a balanced scorecard:

- Instead of only: “Minimize Purchase Price Variance”

- Add: “Supplier Sustainability Score,” “Payment Terms Fairness,” “Innovation Ideas Co-developed.”

- Balance: Cost, Quality, Speed, Resilience, Sustainability, and Partnership Health.

6. Internal Culture & Process

- Avoid Burnout: Reject a “hero culture” of constant fire-fighting. Staff teams adequately (Lagom workload) for sustainable performance.

- Decentralized Decision-Making: Empower local teams to make “right amount” decisions that fit their context, within a framework of guiding principles.

- Mindful Consumption: Internally promote a culture of questioning every purchase request: “Is this necessary? Is this the right amount? Can we use something we already have?”

Visual Model: The Lagom Supply Chain

A Lagom supply chain would look less like a hyper-lean, global race and more like a balanced, regional network:

- Sourcing: Prioritized nearshoring for a balanced risk/cost profile.

- Inventory: Strategic hubs with moderate, optimized stock levels.

- Transport: A mix of modes chosen for total impact (cost + carbon + time).

- Relationships: Long-term, open-book partnerships with key suppliers.

Example: A Furniture Company Applying Lagom

- Procurement: Sources sustainably harvested wood from regional forests (not lowest-cost, global), paying a fair price to support sustainable forestry.

- Design: Creates modular, repairable furniture with minimal, biodegradable packaging.

- Inventory: Keeps core components in stock for quick assembly and repair, but assembles to order.

- Logistics: Uses hybrid electric trucks for last-mile delivery on optimized routes.

- End-of-Life: Offers a take-back program to refurbish or recycle products.

Contrast with Traditional Models

- Traditional Lean/JIT: “Minimize waste, maximize efficiency.” (Can lead to fragility and supplier squeeze).

- Lagom Balanced: “Optimize for resilience, fairness, and sustainability within efficient boundaries.”

Conclusion: The Lagom Advantage

Building a procurement and supply chain on Lagom isn’t about sacrificing profitability. It’s about achieving balanced, long-term prosperity.

Benefits include:

- Enhanced Resilience from balanced buffers and strong partnerships.

- Risk Mitigation through sustainable and ethical practices.

- Brand Trust & Loyalty from conscious consumers.

- Employee Engagement from meaningful, fair work.

- Sustainable Cost Structure through waste reduction and resourcefulness.

Ultimately, a Lagom supply chain is a mature supply chain—one that recognizes that true efficiency is not about relentless minimization, but about finding the “just right” point for all stakeholders: the company, its people, its partners, and the planet.

AI Procurement. How can a company build its procurement and supply chain processes using the Ikigai philosophy?

AI Procurement

How can a company build its procurement and supply chain processes using the Ikigai philosophy?

03.01.2025

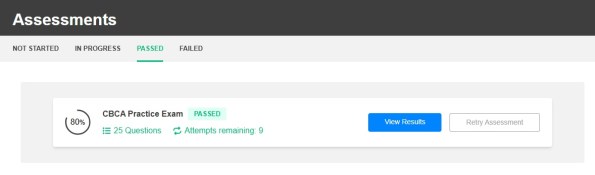

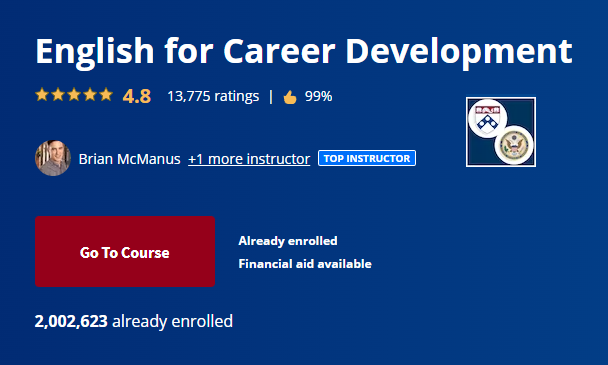

AI Procurement. Top Procurement Courses and Training Worldwide

AI Procurement

What are the best courses and training available in the world for procurement professionals?

02.01.2025

The best procurement training depends heavily on your career stage, specialization, and region. The global landscape offers a mix of prestigious academic degrees, industry-recognized certifications, and elite executive programs. Here’s a breakdown of the top-tier options, categorized for clarity.

1. Premier Global Certifications (Industry-Standard)

These are the most portable and recognized credentials worldwide.

CIPS (Chartered Institute of Procurement & Supply): The global gold

standard, especially in the UK, Commonwealth, and Europe. It is a progressive

qualification from Level 2 to Level 6, culminating in MCIPS (Member). Many

global job descriptions list MCIPS as a requirement.

o Best for: Professionals seeking a comprehensive, globally recognized career

passport in procurement and supply chain.

ISM (Institute for Supply Management) – CPSM/CPSD: The leading authority

in North America. The Certified Professional in Supply Management

(CPSM) is highly respected and focuses on strategic sourcing, finance, and

supply management.

o Best for: Professionals operating in or with North American markets,

emphasizing strategic and financial acumen.

APICS (Association for Supply Chain Management) – CSCP/CPIM: While

broader than procurement, the Certified Supply Chain Professional (CSCP) is

immensely valuable for procurement leaders who need deep integration with the

end-to-end supply chain.

o Best for: Procurement professionals aiming for executive roles where

understanding the full supply chain is critical.

2. Elite Academic & Executive Education

For deep strategic knowledge and networking.

Master’s Degrees:

o MIT Center for Transportation & Logistics (MS in Supply Chain

Management): Arguably the world's top program, with a focus on analytics,

technology, and innovation.

o University of Cambridge – Master of Studies (MSt) in Supply Chain

Leadership: A part-time, modular program for senior professionals, combining

Cambridge’s academic rigor with practical leadership.

o Michigan Ross (Master of Supply Chain Management), Pennsylvania State

University (Smeal), and other top-tier business schools offer excellent

specialized master’s or MBAs with strong procurement concentrations.

Executive Short Courses:

o Harvard Business School (HBS): Offers executive programs like ‘Driving

Strategic Impact: Leading Procurement & Supply Chain

Transformation’ Unparalleled for high-level strategy and leadership.

o INSEAD: Programs like ‘Strategic Procurement in the Digital Age’ focus on

innovation and global strategy.

o Kellogg School of Management (Northwestern): Renowned for Executive

Strategies for Supply Chain Management.

o University of Oxford (Saïd Business School): Courses like ‘Oxford

Programme on Negotiation’ are legendary for procurement leaders.

3. Specialized & Technology-Focused Training

For modern procurement challenges.

Digital Procurement & AI:

o Procurement Leaders / World Commerce & Contracting: Offer courses

on digital transformation, AI in procurement, and advanced analytics.

o Suppliers platforms (like Coupa, SAP Ariba, Jaggaer): Vendor-specific

certifications on Source-to-Pay (S2P) platforms are highly valuable for

operational roles.

Negotiation Mastery:

o The Gap Partnership: Their ‘Advanced Negotiation Programme’ is world-

famous in corporate circles for its strategic methodology.

o Scotwork: Another global leader in negotiation training with a strong track record.

Legal & Contracting:

o World Commerce & Contracting (formerly IACCM): The Certified

Commercial Contracts Manager (CCCM) is the benchmark for contract

management excellence.

4. Leading Online Learning Platforms

For flexible, skill-specific advancement.

Coursera / edX: Host courses from MIT (MicroMasters in Supply Chain),

Rutgers, and ISM. Excellent for foundational and intermediate knowledge.

LinkedIn Learning & Udemy: For tactical skill-building (e.g., ‘Excel for

Procurement’, ‘Introduction to Strategic Sourcing’).

How to Choose: A Strategic Guide

1. For Early-Career Professionals (1-5 years):

o Start with CIPS Level 4/5 or ISM CPSM. They provide a solid foundation. Use

platforms like Coursera for prerequisites.

2. For Mid-Career Managers (5-10 years):

o Complete your MCIPS or CPSM. Pursue specialized training in negotiation

(Gap Partnership) or digital tools. Consider an APICS CSCP to broaden your

perspective.

3. For Senior Leaders & Directors (10+ years):

o Aim for executive education at HBS, INSEAD, or Oxford to build peer networks

and strategic vision. These are for leadership, not just technical skills.

4. For Specialists:

o Category Management: Look for specialized courses from Procurement

Leaders or The Faculty (Australia/Asia).

o Data Analytics: Seek courses in Python, SQL, and spend analytics (via data

science platforms or Coursera).

o Sustainable Procurement: CIPS and ISM now have dedicated modules and

certificates on ESG (Environmental, Social, and Governance).

Final Recommendation:

The Unbeatable Combination: MCIPS (CIPS) + an executive program from a

top-10 business school. This gives you the technical credibility and the strategic

leadership pedigree.

Consider Your Geography: CIPS is stronger in Europe/Asia, ISM in the

Americas. Choose accordingly.

Invest in Networking: The value of programs like HBS or INSEAD often lies as

much in the peer group you join as in the curriculum.

Always check: Does the program offer practical tools, recognized certification, and

a strong alumni network? The "best" course is the one that aligns with your next

career move and fills your most critical skill gaps.

AI Procurement. How can AI be used in the field of procurement?

AI Procurement

How can artificial intelligence be used in the field of enterprise procurement?

01.01.2025

Artificial Intelligence is fundamentally transforming enterprise

procurement from a tactical, administrative function into a strategic, predictive, and autonomous powerhouse. Its applications span the entire Source-to-Pay (S2P) lifecycle.

Here’s a detailed breakdown of how AI is being used in enterprise procurement:

1. Strategic Sourcing & Supplier Management

Intelligent Sourcing & Market Analysis: AI algorithms can scan thousands of

websites, news feeds, and databases to monitor commodity prices, geopolitical risks,

and supply market trends in real-time. This provides predictive insights for optimal

buying timing.

Supplier Discovery & Onboarding: AI can automatically identify and qualify new

suppliers from global databases, analyze their financial health, news sentiment, and

ESG (Environmental, Social, Governance) credentials, drastically reducing onboarding

time.

Supplier Risk Management: AI provides continuous, predictive risk monitoring. It can

flag suppliers at risk of bankruptcy, operational disruption (using weather/social data), or

compliance issues (sanctions, regulatory changes) long before traditional methods.

Automated RFx & Auction Analysis: AI can help structure RFPs, evaluate complex

bid responses (even parsing unstructured text), and suggest optimal award scenarios

beyond just price, considering risk, innovation, and total cost of ownership.

2. Spend Analytics & Cost Optimization

Spend Classification & Cleansing: Machine Learning (ML) models automatically

cleanse and classify 100% of spend data (from messy PO descriptions, invoices) into

accurate, unified categories. This creates a "single source of truth" for spend visibility.

Anomaly Detection & Fraud Prevention: AI identifies patterns indicative of fraud,

maverick spending, or duplicate invoices by comparing transactions against historical

data and defined rules (e.g., purchases just below approval thresholds, unusual vendor

changes).

Predictive Cost Modeling & Should-Cost Analysis: AI models predict future price

points of components/materials based on factors like raw material indices, labor rates,

and demand forecasts, giving procurement powerful negotiation leverage.

3. Procurement Process Automation &Efficiency

Intelligent Process Automation (IPA): Combines RPA (Robotic Process Automation)

with AI to handle complex, judgment-based tasks:

o Touchless Invoice Processing: Computer Vision (OCR++) reads invoices, ML

matches them to POs and delivery receipts, and AI resolves discrepancies—all without

human intervention.

o Automatic Contract Management: NLP (Natural Language Processing) extracts key

clauses (SLAs, termination dates, price escalators) from thousands of contracts,

flagging risks and non-standard terms.

Cognitive Procurement Assistants (Chatbots): AI-powered chatbots handle routine

queries from employees and suppliers, freeing up staff for strategic work.

4. Contract Management & Compliance

Smart Contract Authoring: AI suggests optimal clauses based on category, risk

profile, and jurisdiction, ensuring compliance with company standards.

Obligation Management: AI monitors contract repositories and operational data to

ensure both parties meet obligations (e.g., volume commitments, rebates, innovation

workshops).

Renewal & Opportunity Alerts: AI predicts contract renewal dates and analyzes

spend to recommend consolidation, renegotiation, or switching opportunities.

5. Procurement in the Supply Chain

Predictive Demand Sensing & Inventory Procurement: AI links procurement directly

to the supply chain by predicting demand spikes/slumps more accurately than traditional

forecasts. This triggers autonomous, just-in-time procurement orders to optimize

inventory costs.

Logistics & Shipping Optimization: AI optimizes freight and logistics procurement by

analyzing routes, carrier performance, and costs in real-time.

The Underlying AI Technologies Powering This:

Machine Learning (ML): For pattern recognition, prediction, and classification.

Natural Language Processing (NLP): For understanding contracts, emails, and

specifications.

Computer Vision: For reading documents, invoices, and even monitoring supplier

facilities via satellite imagery.

Robotic Process Automation (RPA): For executing the repetitive tasks AI dictates.

Tangible Benefits for the Enterprise:

Cost Savings: 5-15%+ beyond traditional methods through predictive analytics and

optimization.

Efficiency Gains: Up to 50-70% reduction in manual processing time.

Risk Reduction: Proactive identification of supply, financial, and compliance risks.

Strategic Impact: Frees procurement teams to focus on innovation, supplier

collaboration, and value creation.

Improved Compliance: Enforces policy automatically and provides complete audit

trails.

Challenges & Considerations:

Data Quality: ‘Garbage in, garbage out.’ AI requires clean, integrated data from ERP,

finance, and supply chain systems.

Change Management: Requires reskilling procurement professionals from tactical

buyers to strategic data interpreters and relationship managers.

Ethics & Bias: AI models must be audited to avoid perpetuating bias in supplier

selection.

Integration: Must work seamlessly within existing procurement tech stacks (ERP, S2P

suites like SAP Ariba, Coupa, etc.).

The Future: Autonomous Procurement

The end state is ‘Self-Optimizing Supply Networks.’ AI will not just recommend

actions but will autonomously execute routine procurement—placing orders, negotiating

spot buys, managing supplier risk—within pre-defined strategic guardrails set by

humans.

In summary, AI in procurement moves the function from being reactive and

administrative to being predictive, prescriptive, and ultimately autonomous. It is

the core technology enabling Chief Procurement Officers to become true strategic

partners to the business.

ActiveNature Season 12. Water World

ActiveNature Season 12. Water World

2024

Interesting and rare moments of everyday life on the water surface.

Nature

Season 12. Past Bonus

Baikal, Blue Lagoon, Dead Sea, Jordan River, Pamukkale, Strokkur

Season 16. Future Bonus

Season 18. Future Bonus

Durmitor, Everest, Himalayas, Tara River Canyon

| Activity | Hobby |

| Thermal springs swimming | Archery |

| Mud wrap | Collecting |

| Helicopter flight | Poker |

| Electric scooter | Reading |

| Electric moped | Table tennis |

| Bike | 3D modeling |

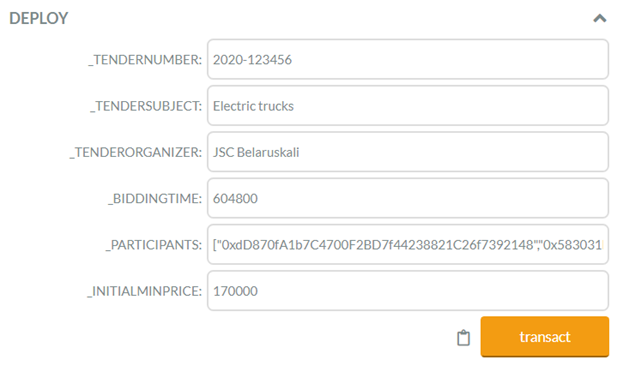

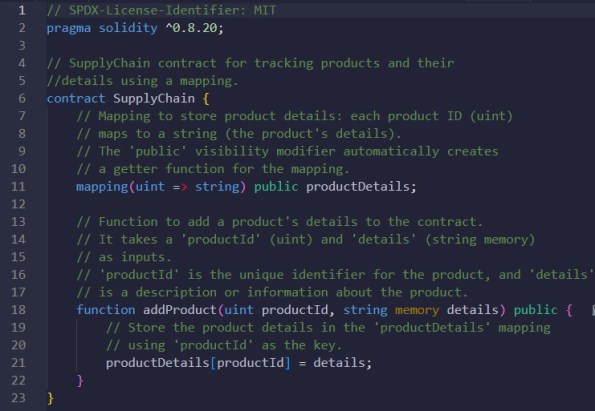

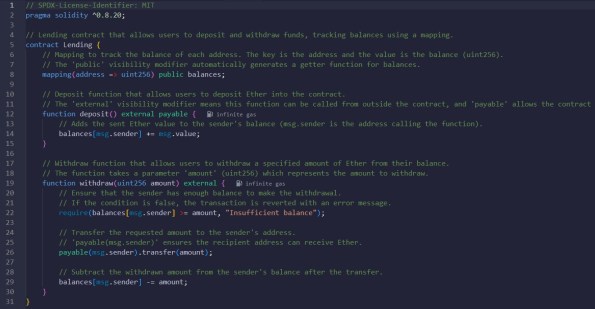

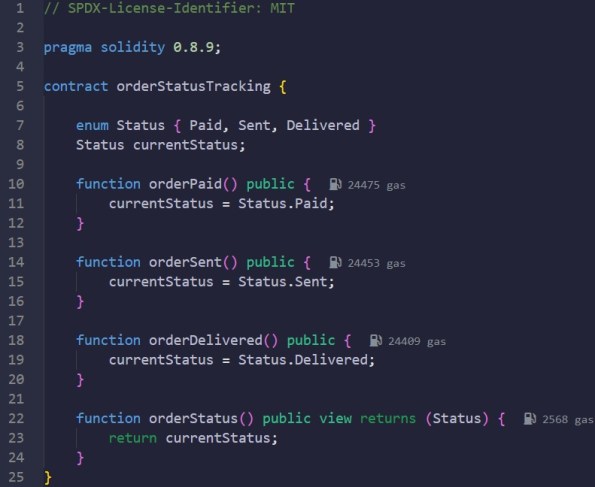

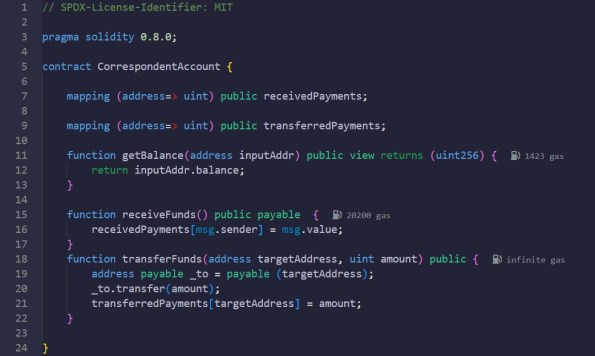

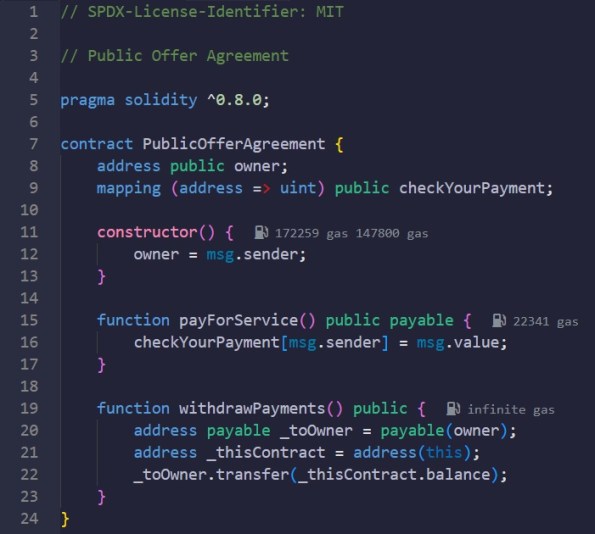

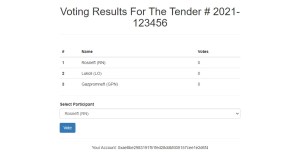

| Car | Website development |

| Roller coaster | Smart contract development |

| Tyrolean traverse | Radio controlled car |

| Skiing | App development |

Season 1. Bonus.

City Insight

Belarus: Turov, Zaslavl, Zhitkovichi

Season 2. Bonus.

City Insight

Andorra: Andorra la Vella

Bosnia and Herzegovina: Sarajevo

France: Blagnac, Rennes, Toulouse

Germany: Bonn, Cologne, Dusseldorf

Greece: Bogetici, Chania, Fira, Firostefani, Oia, Thessaloniki

Malta: Birgu, Cospicua, Floriana, Senglea, Valletta

Montenegro: Kolasin, Niksic, Podgorica, Zabljak

Northern Cyprus: Kyrenia, Nicosia

Romania: Bucharest

Slovakia: Bratislava

Slovenia: Ljubljana

Event Insight

Sport: Paris 2024 Summer Olympic Games, Spa-Francorchamps 2024 Formula 1 Belgium Grand Prix, Spa-Francorchamps 2024 Porsche Mobil 1 Supercup

Place Insight

National Parks: Biogradska Gora, Durmitor, Plitvice Lakes

Heritage: Mont-Saint-Michel, Santorini

Resorts: Canopy by Hilton Zagreb City Centre, Ibis Orly Rungis, Park Inn by Radisson Danube Bratislava, Pullman Cologne, W Barcelona, Westin Zagreb

Wildlife: Tara River Canyon

Season 3. Bonus.

Place Insight

Resorts: Crowne Plaza Istanbul Old City IHG Hotel, Holiday Inn Istanbul Old City IHG Hotel, Renaissance Istanbul Polat Bosphorus Hotel

Season 4. Bonus.

City Insight

China: Guangzhou

Laos: Phonsavan, Thanon Tha, Vientiane

Myanmar: New Bagan, Nyaung-U, Old Bagan, Yangon

Nepal: Bhaktapur, Kathmandu, Lalitpur, Lukla, Pheriche

Vietnam: Ho Chi Minh, My Tho

Place Insight

Heritage: Bagan, Plain of Jars

Resorts: Excelsior Yangon, Fairfield by Marriott Kathmandu, Four Points by Sheraton Guangzhou Baiyun, Grand Hotel Saigon

Wildlife: Everest, Himalayas, Mekong

Season 12. Past Bonus

Place Insight

Wildlife: Blue Lagoon, Strokkur

Stats: Countries 13 (88), Cities 50 (440), Events 3 (65), Places (HandMade+Nature) 26 (101), Activity 10 (20), Hobby 10 (20)

Avalanche Academy

Avalanche Academy

Course “Interchain Messaging”

In this course, you will learn how to build cross-L1 Solidity dApps with Interchain Messaging and Avalanche Warp Messaging.

Course Content

Interoperability

In the first section, we cover some basic concepts of interoperability in multi-chain systems. You will learn about examples of interoperability between blockchains and the terms “source,” “destination,” and “message.”

Avalanche Interchain Messaging

In this section, we learn what Avalanche Interchain Messaging is and what is abstracted away from the general dApp developer. You will also build your first cross-L1 dApps.

Securing Cross-Chain Communication

In this section, we look at techniques to secure cross-chain communication. We dive into signature schemes, multi-signature schemes, and the BLS multi-signature scheme.

Avalanche Interchain Messaging Protocol

Avalanche blockchains can natively interoperate between one another using AWM. You will learn about the AWM message format and how the message flow works.

Learning Outcomes

By the end of this course, students will:

- Understand the challenges of cross-chain communication

- Know what separates Avalanche Warp Messaging from other cross-chain communication protocols

- Understand the differences between Avalanche Warp Messaging and Teleporter

- Apply their knowledge by building cross-Avalanche L1 dApps, such as asset bridges

Topics

- Interoperability between blockchain

- Source, Message and Destination

- Recap of Multi-Chain Networks

- Interoperability in Multi-Chain Systems

- Finality Importance in Interoperabile Systems

- Trusted Third Parties

- Avalanche Starter Kit

- Initial Setup

- Close and Reopen Codespace

- Getting Test Tokens

- Contract Development with Foundry

- Interchain Messaging Basics

- ICM Basics

- Recap of Bytes, Encoding and Decoding

- Sending a Message

- Sender Contract

- Receiving a Message

- Receiver Contract

- Send a Message

- Adapt the contract

- Two-Way Communication

- Sender Contract

- Create the Sender Contract

- Receiver Contract

- Create the Receiver Contract

- Send a Roundtrip Message

- Adapt the Contracts

- Invoking Functions

- Encoding of multiple Values

- Create Simple Calculator Sender

- Create Simple Calculator Receiver

- Call simple Calculator

- Encoding the Function Name

- Extend the Calculator

- Interchain Messaging Registry

- How the ICM Registry works

- Interact with the ICM Registry

- Retrieving Interchain Messenger from the Registry

- Verify if Sender is Interchain Messaging

- Avalanche Warp Messaging

- Recap P-Chain

- Warp Message Format

- AWM Relayer

- Dataflow

- Message Pickup

- Message Delivery

- Load Considerations

- Trust Assumptions

- Running a Relayer

- Relayer Introduction

- Configuration Breakdown

- Configure & Run Relayer

- Restricting-the-relayer

- Restricting a Relayer

- Allowed Relayer

- Incentivizing a Relayer

- Incentivizing a Relayer

- Fee Data Flow

- Determining the Fee

- Setting Incentives

- Deploy Fee Token Contract

- Incentivize an AWM relayer

- Interaction Flow With Fees

Completion Certificate

Avalanche Academy

Avalanche Academy

Course “Interchain Token Transfer”

In this course, you will learn how to transfer assets across multiple Avalanche blockchains with Avalanche Interchain Token Transfer ICTT.

Course Content

Getting Started with Interchain Token Transfer

In this section, you will learn how to use our Interchain Token Transfer toolbox to perform cross-chain operations. We’ll guide you through the process of using our user-friendly interface to deploy contracts, create bridges, and transfer assets across the testnet chains (Fuji C-Chain, Echo, and Dispatch).

Tokens and Token Types

In this section, you will learn about the different types of tokens that can be transferred between Avalanche blockchains. We will cover ERC-20 and native tokens and how to deploy and transfer them using our toolbox. Furthermore, you will learn what wrapped native tokens are and how they can be used to transfer assets between chains.

Token Bridging

Next we will talk about the high level concepts of token bridging and demonstrate how to use our toolbox to create and manage bridge contracts for cross-chain transfers between the testnet chains.

Interchain Token Transfer Architecture

In this chapter we will look at the design of Avalanche Interchain Token Transfer. You will learn about the file structure of the contracts and the concepts of the token home and token remote.

ERC-20 to ERC-20 Bridge Implementation

You will learn how to use our toolbox to deploy ERC-20 tokens and create bridges to transfer them between the testnet chains.

Multi-Chain Token Operations

Here you will learn about the concept of multi-hops and how to use our toolbox to bridge tokens between multiple testnet chains.

Native to ERC-20 Bridge Implementation

In this chapter you will learn how to use our toolbox to bridge a native token as an ERC-20 token to another testnet chain.

Send and Call Operations

In this chapter you will learn how to use our toolbox to call smart contracts with the tokens after sending them to another testnet chain.

Cross-Chain Token Swaps

In this chapter you will learn how to perform cross-chain token swaps between the testnet chains using our toolbox.

Learning Outcomes

By the end of this course, you will:

- Understand what Avalanche Interchain Token Transfer is and when to use it.

- Understand the different options for transferring assets between multiple chains.

- Be able to deploy tokens and create bridges using our toolbox.

- Be able to perform cross-chain token transfers between testnet chains using our toolbox.

- Apply the knowledge gained in the course by enabling assets to be transferred between multiple Avalanche blockchains.

Topics

- Tokens

- Native Tokens

- Transfer Native Tokens

- Transfers and Smart Contract

- ERC-20 Tokens

- Deploy and Transfer an ERC-20 Token

- ERC-20 and Smart Contracts

- Wrapped Native Tokens

- Create a Wrapped Native Token

- Token Bridging

- Bridge Architecture

- Use a Demo Bridge

- Bridge Hacks

- Interchain Token Transfer

- Avalanche Interchain Token Transfer

- Interchain Token Transfer Design

- File Structure

- Token Home

- Token Remote

- ERC-20 to ERC-20 Token Bridge

- ERC-20 to ERC-20 Bridge

- Deploy an ERC-20

- Deploy a Home Contract

- Deploy a Remote Contract

- Register Remote Bridge

- Transfer Tokens

- Integrate ICTT with Core

- Deploy Your Own ICTT Frontend

- ERC-20 Multi-Hop Transfer

- Overview of Multi-hop Transfers

- Deploy Token Remote for Multi-hop

- Register Remote Bridge

- Multi-hop Transfer

- Native to ERC-20 Token Bridge

- Native to ERC-20 Token Bridge Overview

- Deploy Native Token Home

- Deploy ERC20 Token Remote

- Register Remote Bridge

- Native Token Bridge Transfer

- Send and Call

- Introduction

- Send and Call Receivers

- Mock Receivers

- Deploy a Mock Receiver

- Cross-Chain Token Swaps

- Wrap Exchange Contract

- Deploy Wrapped Exchange Contract

- Scaling Token Decimals

- Scaling with TokenRemote

- Example USDC as Native Token (DIY)

Completion Certificate

Avalanche Academy

Avalanche Academy

Course “L1 Tokenomics”

This course is designed to give you a deep understanding of tokenomics, including the creation, distribution, utility, and governance of tokens within blockchain ecosystems. By the end of this course, you will have practical skills in managing tokens across multi-chain ecosystems, configuring transaction fees, and designing staking and governance models.

Course Content

Basics

Learn the fundamentals of tokenomics, including native tokens, ERC-20 tokens, wrapped tokens, and how token decimals affect transactions and supply.

Native Tokens

Explore how to create custom native tokens, use Avalanche’s native token minter, and integrate ERC-20 tokens as native tokens in cross-chain environments.

Multi-Chain Ecosystems

Delve into interchain token transfers and cross-chain functionality, using both ERC-20 and native tokens across multiple blockchains.

Staking

Understand staking tokens, liquid staking, and how to deploy staking contracts, with a focus on post-Etna upgrade features.

Transaction Fees

Master transaction fee configuration, dynamic fee models, and learn how to distribute fees effectively within decentralized ecosystems.

Token Distribution

Learn about initial token allocation, advanced vesting schedules, bonding curves for token pricing, and how to implement airdrops.

Governance

Study governance models, DAOs, quadratic voting, and the latest innovations in governance (Governance 2.0) for decentralized decision-making.

Learning Outcomes

By the end of this course, you will:

- Gain a solid grasp of token fundamentals, tokenomics models, and how to create sustainable token economies.

- Learn how to create custom native tokens and integrate ERC-20 tokens as native tokens in multi-chain environments.

- Understand the challenges and opportunities in cross-chain token transfers, and liquidity management.

- Master the technical aspects of configuring transaction fees, setting up staking contracts, and designing dynamic fee models.

- Create initial allocation plans, implement advanced vesting schedules, and manage bonding curves and airdrops.

- Develop governance structures, including DAOs and quadratic voting models, to manage decentralized decision-making effectively.

Topics

- Basics

- Native Tokens

- ERC-20 Tokens

- Deploy and Transfer an ERC-20 Token

- Wrapped Native Tokens

- Deploy and Interact with Wrapped Token

- Token Decimals

- Advanced Native Tokens

- Custom Native Tokens

- Configure Custom Native Tokens

- Native Token Allocation

- Activating Native Minter Precompile

- Native Minter Precompile

- Use ERC-20 as Native Token

- Multi-Chain Ecosystems

- Introduction

- Interchain Token Transfers

- Use ERC-20 as Native Token (DIY)

- Use any Native as Native Token (DIY)

- Cross-Chain Liquidity Pools

- Quiz Time

- Staking

- Introduction

- Liquid Staking

- Staking Contract (post Etna Upgrade)

- Registering PoS Validators

- Transaction Fees

- Introduction

- Transaction Fee Configuration

- Dynamic Fee Configuration

- Fee Distribution

- Token Distribution

- Initial Allocation

- Vesting Schedules

- Bonding Curves

- Airdrops

- Governance

- Introduction

- Governance Models

- DAOs

- Quadratic Voting

- Governance 2.0

- Conclusion

Completion Certificate

Avalanche Academy

Avalanche Academy

Course “Avalanche Fundamentals”

This online course introducing you to the exciting world of the Avalanche technology! This course will provide you with a comprehensive understanding of the basic concepts making Avalanche unique.

Throughout, you’ll learn the key features and benefits of the platform, plus how to build on it. You can also ask our expert instructors questions.

By the end of these courses, you’ll have the knowledge and skills to leverage the power of blockchain technology for your own projects and applications. We’re excited to have you join us on this journey and can’t wait to see what you’ll create with Avalanche!

By the end of this course, you will:

- Understand how Avalanche consensus works and what makes it different.

- Understand how Avalanche L1s enable scalability, customizability, and independence.

- Understand the Primary Network, a special Avalanche L1, and how to interact with it.

- Understand how Virtual Machines enable developers to create more optimized and capable blockchain systems and to tackle completely new use cases unachievable with previous solutions.

You can evaluate your own understanding of the material through quizzes and claim a certificate for successful completion at the end.

Overall, this course aims to provide a foundational understanding of Avalanche. By completing it, you will be better prepared to take on more advanced courses focused on building on Avalanche.

Topics

- Avalanche Consensus

- Consensus Mechanisms

- Snowman Consensus